Using the most recent returns from September 2021, we will examine Summer recent KiwiSaver Performance.

The Summer KiwiSaver Scheme is run by Forsyth Barr. Forsyth Barr is a New Zealand owned company and they have a history of over 80 years of helping New Zealanders achieve their investment objectives. The Summer KiwiSaver Scheme manages nine funds and has total KiwiSaver Assets Under Management of over $166 million and has 4,356 KiwiSaver clients.

During September, the Global Equity Markets had a challenging month due to a slowing global economy, worsening supply chain, and the potential Evergrande bankruptcy in China dented investor sentiment. Because of the Global Equity markets condition, there was a decline in Summer’s funds’ recent returns.

Table of Contents

Performance of Summer KiwiSaver Funds

Summer Cash Fund

Summer Conservative Fund

Summer Balanced Fund

Summer Growth Fund

Performance of Summer KiwiSaver Funds

|

1 month |

3 months |

1 year |

3 years |

Since Inception |

|

|

Cash |

0.03% |

0.03% |

-0.03% |

0.42% |

0.65% |

|

Conservative |

-0.20% |

-1.74% |

0.67% |

NA |

3.56% |

|

Balanced |

-0.44% |

-1.86% |

3.60% |

7.47% |

6.59% |

|

Growth |

-0.78% |

-2.00% |

6.47% |

NA |

7.95% |

Sourced from Summer fund performance report

* These returns are to the 30th of November 2021 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Summer Quarterly Fund updates published in September 2021 .

Summer Cash Fund

The fund invests in cash, selected cash equivalents and selected short-term New Zealand fixed interest assets. We aim to achieve competitive returns compared to money held on call. These kinds of investments will typically have lower returns and very low levels of volatility. The Cash Fund has had a 1-month return of 0.03%, a negative 1-year return of -0.03% and a since inception return of 0.65%.

*The following is Sourced from Summer Cash Fund Update

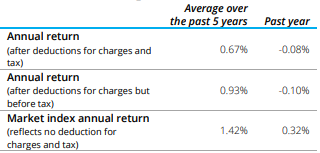

Returns

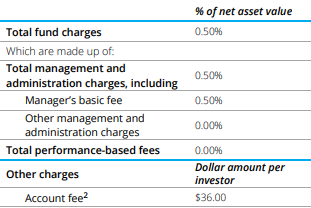

Fees

The total annual fees for investors in the Summer Cash fund are 0.5% per year.

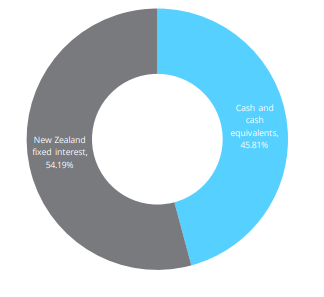

Investment mix

The investment mix is 100% cash and cash equivalents due to being a cash fund.

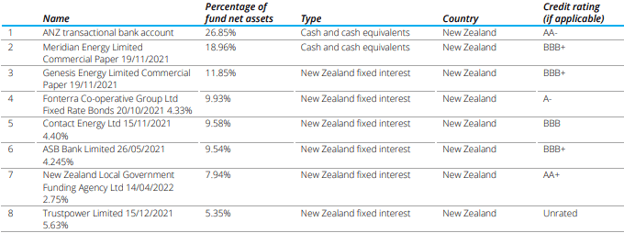

Top ten investments

This table shows Summer’s top 10 investments in the Cash KiwiSaver fund, which make up 100% of the fund.

Summer Conservative Fund

The Conservative Fund aims to achieve positive long-term returns by choosing a greater exposure to cash and fixed interest investments and smaller exposure to equity and property investments. Investors can expect low to moderate levels of volatility and to receive longer-term returns that are lower than those of Summer Balanced Selection. The Conservative Fund had a 1-month return of -0.20%, a 1-year return of 0.67% and a since inception return of 3.56%.

*The following is Sourced from Summer Conservative Fund Update

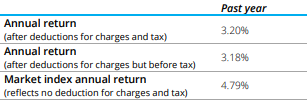

Returns

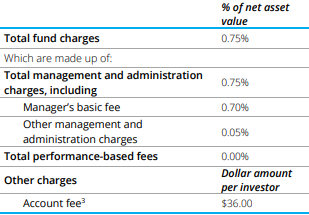

Fees

The total annual fees for investors in the Summer Conservative fund are 0.75% per year.

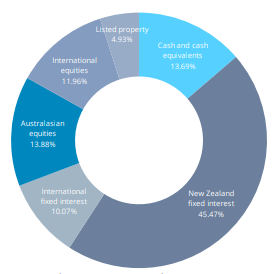

Investment mix

The investment mix shows the type of assets that the fund invests into.

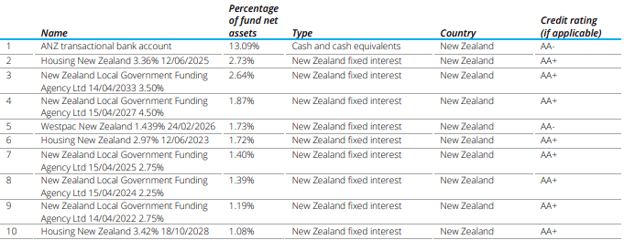

Top ten investments

This table shows Summer’s top 10 investments in the Conservative KiwiSaver fund, which make up 28.84% of the fund.

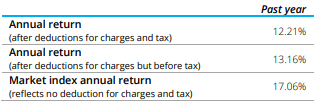

Summer Balanced Fund

The Balanced Fund aims to achieve positive long-term returns by choosing a mix of cash, fixed interest, equity and property investments. Investors can expect moderate to high levels of volatility and to receive longer-term returns that are higher than those of the Summer Conservative Selection but lower than those of the Summer Growth Selection. The Balanced Fund has had a 1-month return of -0.44%, 1-year return of 3.60% and a since inception return of 6.59%.

*The following is Sourced from Summer Balanced Fund Update

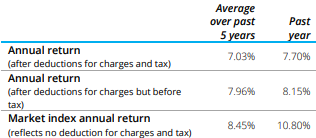

Returns

Fees

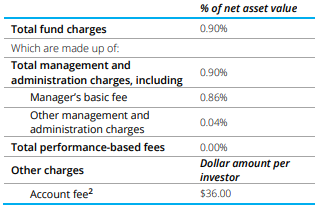

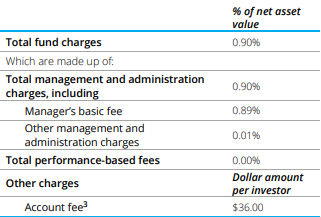

The total annual fees for investors in the Summer Balanced fund are 0.90% per year.

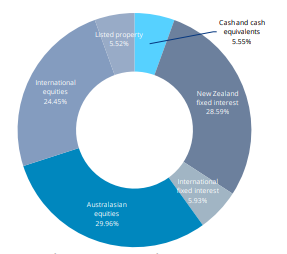

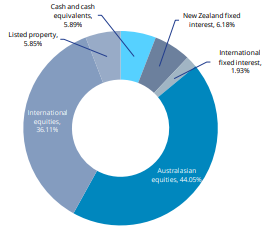

Investment mix

The investment mix shows the type of assets that the fund invests into.

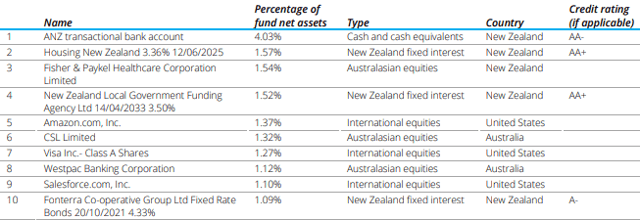

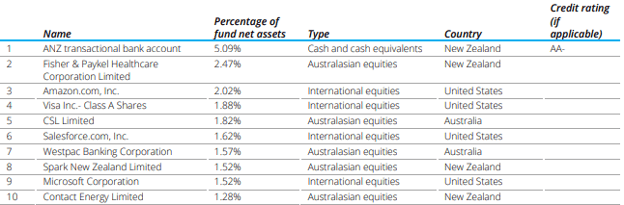

Top ten investments

This table shows Summer’s top 10 investments in the Balanced KiwiSaver fund, which make up 15.93% of the fund.

Summer Growth Fund

The Growth Fund aims to achieve positive long-term returns by choosing a lesser exposure to cash and fixed interest investments and larger exposure to equity and property investments. Investors can expect moderate to high levels of volatility and to receive longer-term returns that are higher than those of Summer Balanced Selection. The Growth Fund has a 1-month return of -0.78%, a 1-year return of 6.47% close to the since inception return of 7.95%.

*The following is Sourced from Summer Growth Fund Update

Returns

Fees

The total annual fees for investors in the Summer Growth fund are 0.90% per year.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows Summer’s top 10 investments in the Growth KiwiSaver fund, which make up 20.79% of the fund.

Data for Summer KiwiSaver funds have been sourced from Summer KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Summer has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.