The best performing Growth fund in the last 5 years was the Milford KiwiSaver Plans Active Growth Fund. As of June 2020, it returned 9.8% annually over the last 5-years (Source: MorningStar). You can find a complete table of the best performing funds in the various KiwiSaver fund categories here on our website. But it's important for you to read the following before you decide on a KiwiSaver fund because you can lose money even if you find the best performing fund.

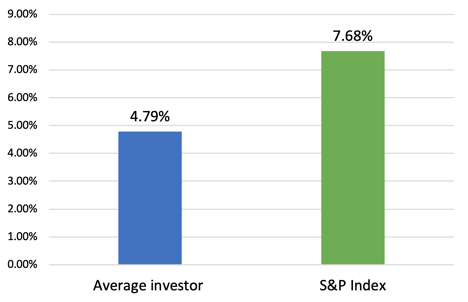

The Dalbar Study: The average investor made 2.89% less every year than the market index

The Dalbar's Investor Returns study which was started in 1994 and is now in its 25th year, shows the difference between the returns of the market index and the actual results of investors.

The 2017 report showed that the 20-year annualised S&P return was 7.68% while the 20-year annualised return for the Average Equity Fund Investor was only 4.79%, a gap of -2.89% annualised.

In layman's terms, the average investor made 2.89% less every year than the market index.

Difference in Returns

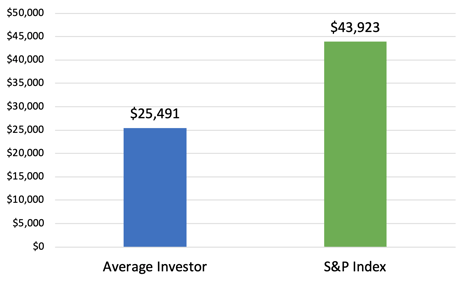

Growth of $20,000 over 20 years

The Magellan Fund

Peter Lynch is considered one of the world's greatest investors. He ran Fidelity Investments Magellan fund from 1977 to 1990. During his tenure from 1977-1990, the Magellan fund's average annual return during this period was 29% (Source: Wall Street Journal). You would think the average investor in the fund made a lot of money

But no. The average investor in the Magellan fund actually lost money. You read that correctly. So even when investors can find good investments, why do they consistently perform poorly with their investments?

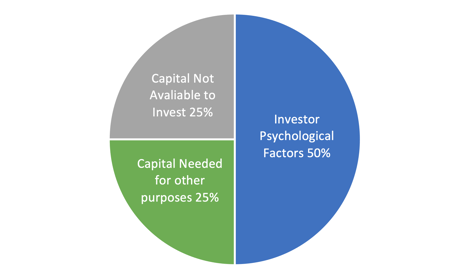

According to the Dalbar study there are three primary reasons for this:

1. Investor Psychology

This is real. All investors are human after all, and being human comes with certain biases. Behavioural biases are the single largest contributor to investor underperformance. Five of the significant investment behaviour biases are:

-

Loss Aversion - The fear of loss leads to a withdrawal of capital at the worst possible time. Also known as "panic selling."

-

Narrow Framing - Making decisions about part of the portfolio without considering the effects on the total.

-

Anchoring - The process of remaining focused on what happened previously and not adapting to a changing market.

-

Herding effect - Following what everyone else is doing. Leads to "buy high/sell low."

-

Media Response - Knee Jerk responses by the Investor to what they read or hear in the media.

2. Capital Not Available to Invest and Capital Needed for Other Purposes

These two factors are due to lack of financial planning which takes into consideration the time frame of your investment. As an investor, you have to consider how long you have before you need to withdraw your KiwiSaver funds (This is called Volatility Capacity). That information will form part of your plan and lead to the selection of the appropriate type of KiwiSaver fund for you.

So what should you do about this?

Researching the best KiwiSaver fund and comparing to other KiwiSaver fund in the market is a good step. But you need to do much more. At National Capital, these are the 3 tasks we perform to guide our clients.

1. Plan

We help them plan their KiwiSaver investments correctly. We do this by determining their Volatility Capacity, Volatility Tolerance and the actual Returns Required to fulfil their goals. This helps us select the right type of KiwiSaver fund.

2. Understand

We then go one step ahead. We have developed a 360° Investor Behavioural Analysis tool for our clients via which we understand their Investment biases and manage them accordingly.

3. Research

Finally, we research the KiwiSaver funds we are recommending to make sure they are managed well. Our research on the KiwiSaver funds we recommend covers:

- Culture of the company running the fund. Are they focussed on the investor or only growing the business?

- Volatility dependent performance : How is the performance compared to other funds, and how much risk is the fund taking to achieve that performance.

- Fees : Are the fees reasonable and how do they compare to similar funds?

- Portfolio : What is the asset split, which countries are the funds invested in. How much of the funds are invested in New Zealand, and what are the liquid assets that the fund has?

- People : Who are the people running the fund and how long have they been in that role. Do they have the experience and skills required to manage the fund, and does their remuneration align them with the interests of the investors?

- Investment Processes : What are the governance processes of the fund, what is their brokerage execution policy and how much portfolio turnover do they have?

Using all this information we then recommend the appropriate fund for our clients.

This is a lot, what will you charge me?

Our KiwiSaver advice is absolutely free of charge to you. There are two reasons for this:

Reason 1 : We get paid a fee by the KiwiSaver Schemes to provide this service, similar to how a Mortgage Adviser is paid by the banks. This way you get the advice for free, we still get paid and the KiwiSaver providers can ensure their clients are being taken care of by a Financial Adviser. So it's a win-win situation for all parties. We work with multiple KiwiSaver providers, so that we can choose the best fund for you.

Reason 2 : We're a Kiwi company and we care about Kiwis. Our mission is to help 1 million Kiwis become financially secure. National Capital was formed on the Māori principles of pūataata (transparency), tikanga(the correct way) and taurikura (prosperity). We believe by helping Kiwis achieve financial security via KiwiSaver, we can best achieve our mission.

What next?

If you would like us to create a KiwiSaver plan for you, and select the appropriate fund based on that plan, please submit the form below to start the process. Our KiwiSaver advice process is 100% online so you can do it from the comforts of your own home.

If you would prefer to talk to us on the phone or person, we are happy to do that too.