Using the most recent returns from March 2022, we will examine Lifestages's recent KiwiSaver Performance.

Lifestages operates within the operating division of Funds Administration New Zealand Limited (FANZ), which is a subsidiary of the SBS bank. As of right now, the Lifestages KiwiSaver scheme manages eight funds of a fund under management of over NZ$366m for 19,152 clients.

In March 2022, investors weighed the implications of the invasion war and the accompanying sanctions on Russia on economic growth, energy prices, and global trade. Overall, this had a significant impact on financial markets throughout the globe.

Table of Contents

Performance of Lifestages KiwiSaver Funds

Performance of Lifestages KiwiSaver Funds

|

1 month |

3 months |

1 year |

3 years |

5 years |

|

|

Income |

-0.90% |

-2.75% |

-2.69% |

0.34% |

1.20% |

|

High Growth |

1.49% |

-7.10% |

4.39% |

9.08% |

8.53% |

Sourced from Lifestages fund performance report

* These returns are to 31 March 2022 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Lifestages Quarterly Fund updates published in February 2022.

Lifestages Income Fund

Lifestages Income Fund provides investors with a low-risk investment option that invests predominantly in income-producing assets, the majority of these being a cash and fixed interest investments. The Income Fund may also hold high dividend-yielding equities and/or listed property and infrastructure investments. The Income Fund has had a 1-months and 1-year return of -0.90% and -2.69%, while the 5-years return of 1.20%.

*The following is Sourced from Lifestages Income Fund Update

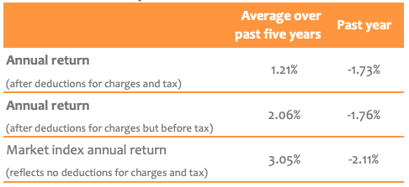

Returns

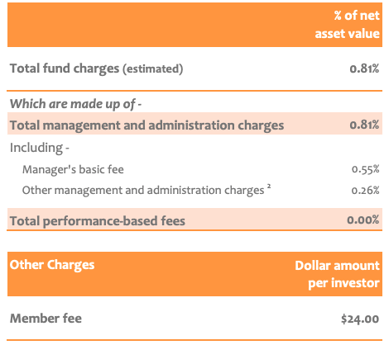

Fees

The total annual fees for investors in the Lifestages Income fund are 0.81% per year with a $24 membership fee.

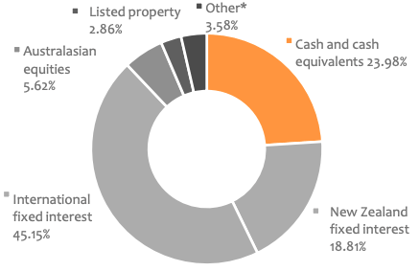

Investment mix

The investment mix shows the type of assets that the fund invests into.

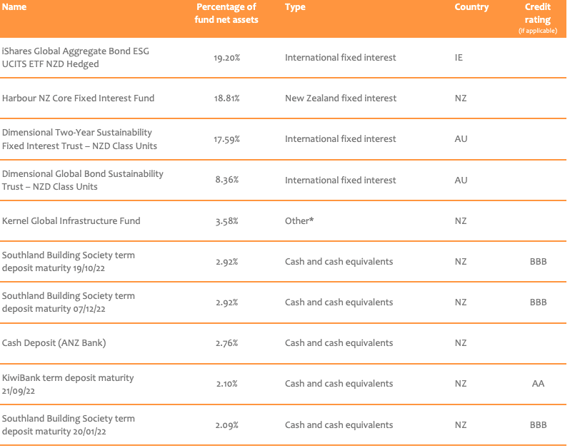

Top ten investments

This table shows Lifestages’s top 10 investments in the Income KiwiSaver fund, which make up 80.33% of the fund.

Lifestages High Growth Fund

Lifestages High Growth Fund provides investors with capital growth over the long-term, by investing primarily in a broad spread of New Zealand and international growth assets, with a small amount held in cash. The High Growth Fund has had a 1-months and 1-year return of 1.49% and 4.39%, while the 5-years return had 8.53%. This indicates that the fund is generating returns, but not exceeding its 5-years benchmark.

*The following is Sourced from Lifestages High Growth Fund Update

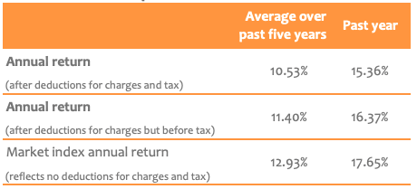

Returns

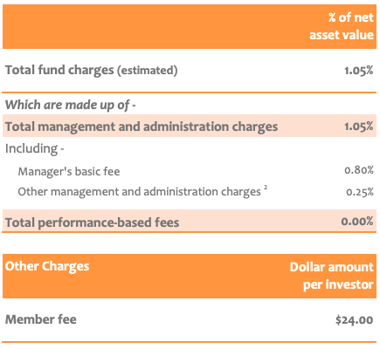

Fees

The total annual fees for investors in the Lifestages High Growth fund are 1.05% per year.

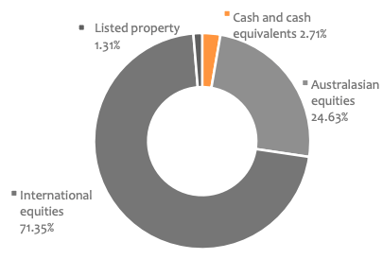

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows Lifestages’s top 10 investments in the High Growth KiwiSaver fund, which make up 59.26% of the fund.

Data for Lifestages KiwiSaver funds have been sourced from Lifestages KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Lifestages has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.