Once you turn 65, you have the chance to finally withdraw the KiwiSaver balance that you’ve accumulated throughout your working life. Where and how will you spend it?

It’s tricky to figure out how much of your KiwiSaver funds you should spend vs save as there are so many uncertain factors. These decisions depend on a variety of factors such as your preference for income now or later, certainty, risk, and leaving an inheritance. There’s no right or wrong way to spend your own money, but many retirees aim not to spend too much – or too little.

Spend it, but don’t blow it all at once

You’ve worked hard throughout your working life and now is the time to relax and enjoy your retirement. The most precious thing is time, so go do those things you’ve been waiting to do and don’t forget to occasionally treat yourself! On the flip side, remember that your KiwiSaver savings are part of your retirement income for the years to come. In retirement, it will be difficult to recover your funds if things go wrong.

As of April 2020, married couples who both qualify for NZ Super can get a combined NZ Super payment of $652 per week, that’s only about $34,000 a year (after tax, assuming ‘M’ tax rate) (Source: Work and Income). As there is a big difference in the desired retirement living standards and what can be achieved with NZ Super, having a sound retirement spending plan in place may be worthwhile.

What will you be doing in retirement?

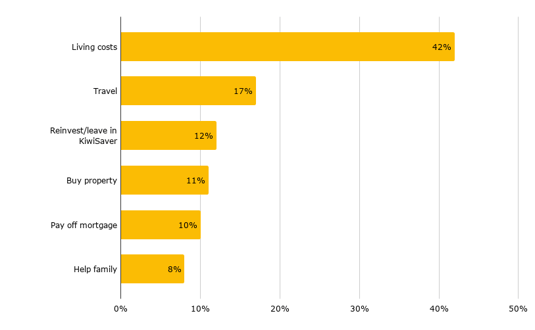

As there is no official retirement age in New Zealand, many New Zealanders continue to work past 65. With the current life expectancy of New Zealanders being 86 for men and 88 for women, we can expect Kiwis to have around 21 to 23 years to spend their KiwiSaver savings. As your needs and wants change throughout the different stages of your retirement, so will your spending. Your retirement spending is based on your situation and goals. Do you want to use your KiwiSaver funds to travel, pay off debt, or to subsidise living costs? The graph below shows what people told ASB they would be using their KiwiSaver funds for:

(Source: Stuff)

There’s no one way on how and where you should spend your money. However, the New Zealand Society of Actuaries shares some common techniques on how retirees can stretch out their savings. Here are four common decumulation techniques.

4 Decumulation Rules of Thumb

Life Expectancy Rule: Each year, calculate the current value of your savings divided by your average life expectancy at the time. This rule is suitable for those who want to maximise their retirement income and are not focused on leaving an inheritance.

6% Rule: Each year, take out 6% of the starting value of your KiwiSaver lump sum. This rule is suitable for those who want to spend more at the start of retirement and are not focused on leaving an inheritance.

Inflated 4% Rule: Take 4% of the starting value of your KiwiSaver lump sum and increase that amount each year with inflation. This rule works well for those who are worried about running out of money and would like to leave an inheritance.

Fixed Date Rule: Have a set fixed date and run your retirement savings down to a set date. Each year, take out the current value of your retirement savings and divide it by the number of years left to that date. This method is suitable for those who are okay with living off NZ Super after the chosen fixed date.

(Source: NZ Society of Actuaries)

These four decumulation rules are only general in terms of advice. For personalised financial advice, we recommend you to speak with a financial advisor.

Live Your Best Life

Retirement is so much more than following a strict budget or plan. Yes, having a good retirement plan and budget can help make retirement stress free, but at the end of the day, retirement is what you make of it. Create a bucket list, explore a new hobby, make new friends, start a vegetable garden. Surrounding yourself with those you love may help you with your transition into retirement a lot easier.

Remember, you’re retiring from work, not from life. Although there may be times in retirement where you might feel lost, remember that retirement gifts you the freedom to live the way you want to.

True wealth isn’t always money. If you’re happy, healthy, and feel secure in retirement – that’s living your best life.