Using the most recent returns from September 2021, we will examine Kiwi Wealth recent KiwiSaver Performance.

Kiwi Wealth Kiwisaver scheme is a 100% New Zealand owned and operated wealth and investment organisation with a strong track record of growth and innovation. They want to help Kiwis create better financial futures by understanding more about how they can grow their wealth - and their values lie at the heart of that.

During September, the share market and Kiwi Wealth’s KiwiSaver Funds had a drop in returns. The reductions could be caused by Auckland still being in lockdown, and the market is settling down after last year's significant returns or another external factor. However, in November, Kiwi Wealth’s returns are now all positive, and investors in KiwiSaver shouldn’t worry as it's natural for the market to have ups and downs because it doesn't always indicate the long-term performance of these funds

Table of Contents

News about Kiwi Wealth

Performance of Kiwi Wealth KiwiSaver Funds

Kiwi Wealth Cash Fund

Kiwi Wealth Conservative Fund

Kiwi Wealth Balanced Fund

Kiwi Wealth Growth Fund

News about Kiwi Wealth

Kiwi Wealth will be remaining a default provider. However, because default funds have changed from conservative to balanced funds, their previous default fund has been renamed the Conservative Default Fund. The new default fund is now called the Balanced Default Fund.

Performance of Kiwi Wealth KiwiSaver Funds

|

Cash |

Conservative |

Balanced |

Growth |

|

|

1 month |

0.04% |

0.13% |

0.06% |

0.01% |

|

3 months |

0.12% |

-2.12% |

-1.14% |

-0.30% |

|

1 year |

0.52% |

1.96% |

10.08% |

17.42% |

|

2 years |

0.91% |

4.72% |

9.73% |

13.84% |

|

3 years |

1.41% |

5.89% |

10.14% |

13.75% |

|

5 years |

1.94% |

5.41% |

9.07% |

12.29% |

|

Since Inception |

2.64% |

5.43% |

6.76% |

7.39% |

Sourced from Kiwi Wealth fund performance reports

* These returns are to 30 November 2021 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Kiwi Wealth Quarterly Fund updates published on the 29th of October.

Kiwi Wealth Cash Fund

The Cash Fund is invested 100% in cash assets. It is a fund with little to no volatility, and its objective is to exceed the returns you would receive from investing 100% of your funds in New Zealand cash through the active selection of cash assets. The 1-month return is 0.04%, the 1-year return is 0.52%, and the since inception return was 2.64%, all showing a positive return as expected from a cash fund.

*The following is Sourced from Kiwi Wealth Cash fund update

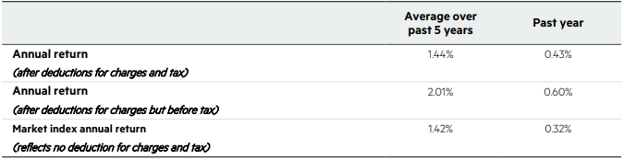

Returns

Fees

The total annual fees for investors in the Kiwi Wealth Cash fund are 0.45% per year, with a minimum fee of $40. The minimum fee only affects balances under $8,000.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a cash fund.

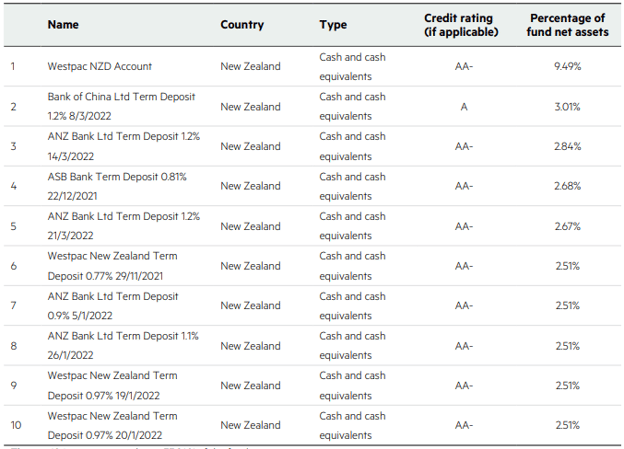

Top ten investments

This table shows Kiwi Wealth’s top 10 investments in the Cash KiwiSaver fund, which make up 33.24% of the fund.

Kiwi Wealth Conservative Fund

The Conservative Fund is for investors with low volatility tolerances and aims to exceed the returns you would receive from investing 70% of your funds in New Zealand fixed interest assets and cash and 30% in shares. The fund has a positive 1-month return of 0.13% and a 1-year return of 1.96% that is considerably lower than the since inception return of 5.43%.

*The following is Sourced from Kiwi Wealth Conservative fund update

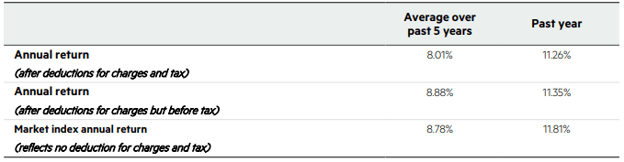

Returns

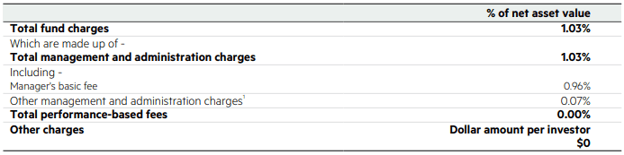

Fees

The total annual fees for investors in the Kiwi Wealth Conservative fund are 0.87% per year because the manager's basic fee has been changed to 0.83%.

The annual manager’s basic fee each member pays is subject to a minimum fee of $40 per annum. For members with an account balance of less than $4,819, the actual manager’s basic fee charged as a percentage of the member account balance may be higher due to the minimum fee.

Investment mix

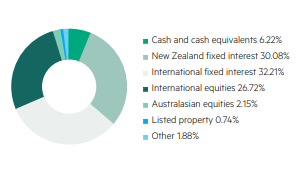

The investment mix shows the type of assets that the fund invests into.

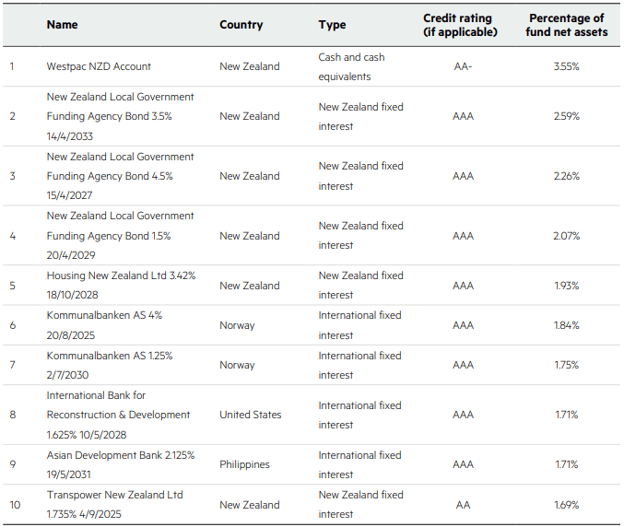

Top ten investments

This table shows Kiwi Wealth’s top 10 investments in the Conservative KiwiSaver fund, which make up 21.10% of the fund.

Kiwi Wealth Balanced Fund

The Balanced Fund is intended for investors who want to balance volatility and returns between the Conservative Fund and Growth Fund. The fund's objective is to exceed the returns you would receive from investing 45% of your funds in New Zealand fixed interest assets and cash and 55% in shares. The Balanced Fund has had a 1-month return of 0.06% and a 1-year return of 10.08%, which is a sizable increase in comparison to the since inception return of 6.76%.

*The following is Sourced from Kiwi Wealth Balanced fund update

Returns

Fees

The total annual fees for investors in the Kiwi Wealth Balanced fund are 1.02% per year because the manager's basic fee has been changed to 0.95%.

The annual manager’s basic fee each member pays is subject to a minimum fee of $40 per annum. For members with an account balance of less than $4,210, the actual manager’s basic fee charged as a percentage of the member account balance may be higher due to the minimum fee.

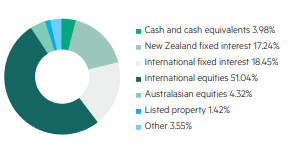

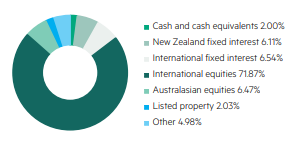

Investment mix

The investment mix shows the type of assets that the fund invests into.

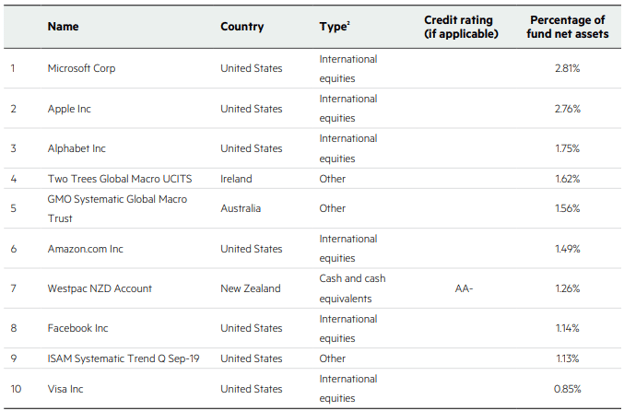

Top ten investments

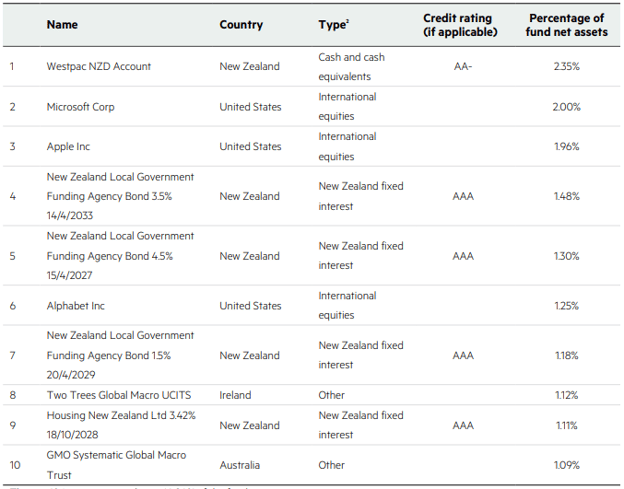

This table shows Kiwi Wealth’s top 10 investments in the Balanced KiwiSaver fund, which make up 14.84% of the fund.

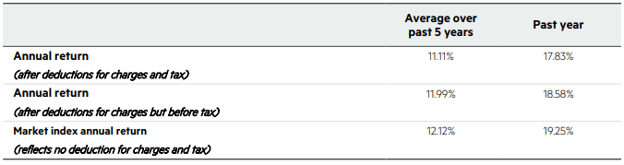

Kiwi Wealth Growth Fund

The Growth Fund is invested up to 90% in shares and other growth assets, with the remainder invested in fixed interest and cash assets. The fund is made for high volatility investors to exceed the returns you would receive from investing 80% of your funds in shares and 20% of your funds in fixed interest assets. The Growth fund had a slightly positive 1-month return of 0.01%, but this hasn’t severely impacted the large 1-year return of 17.42%, which is substantially larger compared to the since inception return of 7.39%.

*The following is Sourced from Kiwi Wealth Growth fund update

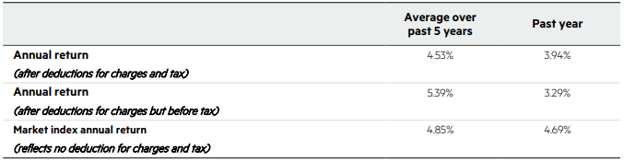

Returns

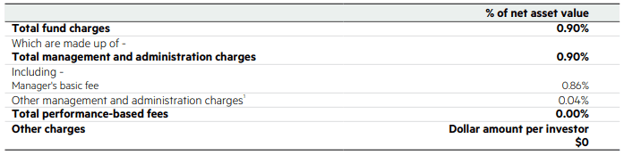

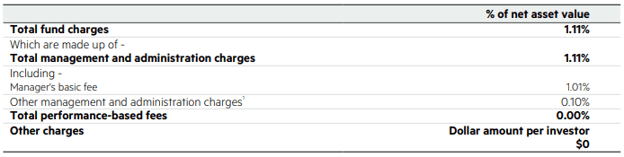

Fees

The total annual fees for investors in the Kiwi Wealth Growth fund are 1.10% per year because the manager's basic fee has been changed to 1.00%.

The annual manager’s basic fee each member pays is subject to a minimum fee of $40 per annum. For members with an account balance of less than $4,000, the actual manager’s basic fee charged as a percentage of the member account balance may be higher due to the minimum fee.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows Kiwi Wealth’s top 10 investments in the Growth KiwiSaver fund, which make up 16.37% of the fund.

Kiwi Wealth KiwiSaver fund data has been sourced from Kiwi Wealth KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Kiwi Wealth has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.