Using the most recent returns from September 2021, we will examine Foundation Series recent KiwiSaver Performance.

Foundation Series is run by Invest Now, which is a New Zealand-based online investment platform that gives Kiwi investors the opportunity to invest in KiwiSaver, Managed Funds and Term Deposits from fund managers and banks around the world. It is designed specifically to give everyday New Zealanders the ability to invest without needing to go through a financial advisor or broker. However, you will receive very little financial advice.

During September, there were many negative returns, possibly due to the Covid pandemic, economic state and lockdown. Despite this, there is a more positive outlook from October and November, with returns on track being positive with the ending of lockdown and the markets readjusting after Covid.

Table of Contents

News about Foundation Series

Performance of Foundation Series KiwiSaver Funds

Foundation Series Balanced Fund

Foundation Series Growth Fund

News about Foundation Series

In September, Harbour Asset Management bought the $1 billion-plus Hunter Global Fixed Interest Fund, including the Foundation Series Funds. Therefore, the issuer and manager of the Hunter Global Fixed Interest Fund will change from Implemented Investment Solutions (ISS) to Harbour Asset Management Limited.

Performance of Foundation Series KiwiSaver Funds

|

1 month |

3 months |

6 months |

1 year |

|

|

Balanced |

1.71% |

0.03% |

5.67% |

9.19% |

|

Growth |

2.22% |

0.79% |

8.23% |

13.81% |

Sourced from Foundation Series fund performance report

* These returns are to 30 November 2021 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Foundation Series Quarterly Fund updates published on the 29th of October.

Foundation Series Balanced Fund

The Foundation Series Balanced Fund is intended to perform in line with the return of its investment benchmark over the long term. The Balanced Fund's strategy aims for mid-range long-term returns by investing in a diversified portfolio with a balance of income and growth assets for investors with a balanced tolerance. The 1-month return for the fund was 1.71%, and the 1-year return was 9.19%. Because the fund has not been in existence for long (2nd Sep 2020), there is no long term past performance to indicate future performance.

*The following is Sourced from Foundation Series Balanced Fund Update

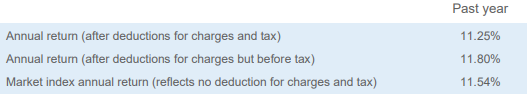

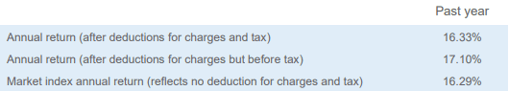

Returns

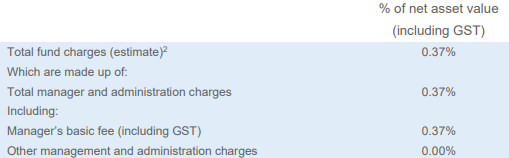

Fees

The total annual fees for investors in the Foundation Series Balanced fund are 0.37% per year.

*Investors may also be charged fees for individual actions, such as moving or switching funds.

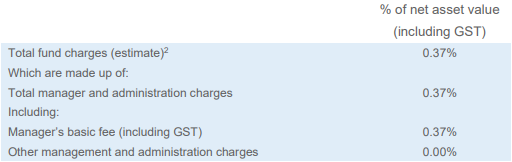

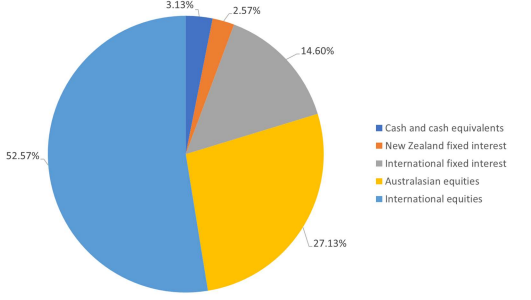

Investment mix

The investment mix shows the type of assets that the fund invests into.

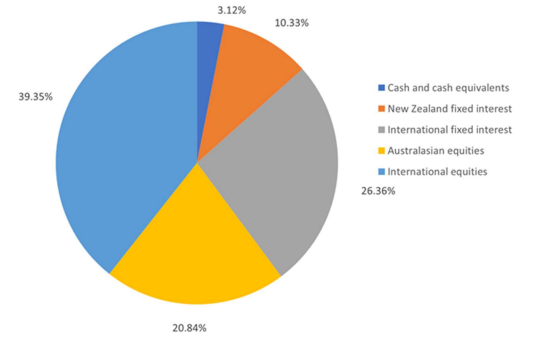

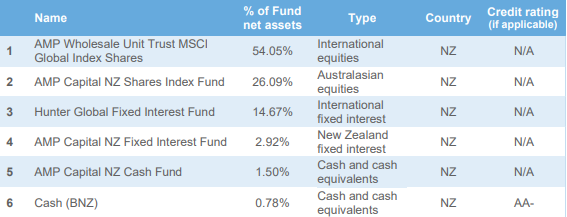

Top ten investments

This table shows Foundation Series’s top 10 investments in the Balanced KiwiSaver fund, which make up 100% of the fund.

Foundation Series Growth Fund

The Fund aims to perform in line with the return of its investment benchmark before fees and tax over the long-term. The Growth Fund aims for high long term returns by investing in a diversified portfolio weighted towards growth assets but with some income asset exposure for investors with higher volatility tolerances. The Fund had a 1-month return of 2.22% with a 1-year return of 13.81%, and like the Balanced Fund, the Growth Fund has only accepted contributions since the 2nd of September 2020.

*The following is Sourced from Foundation Series Growth Fund Update

Returns

Fees

The total annual fees for investors in the Foundation Series Growth fund are 0.37% per year.

*Investors may also be charged fees for individual actions, such as moving or switching funds.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows Foundation Series’s top 10 investments in the Growth KiwiSaver fund, which make up 100% of the fund.

Data for Foundation Series KiwiSaver funds have been sourced from Foundation Series KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Foundation Series has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.