Using the most recent returns from September 2021, we will examine Generate recent KiwiSaver Performance.

Generate KiwiSaver Scheme is New Zealand owned and operated and over the last six years, Generate has led its industry with more than 90% of all new Generate KiwiSaver members speaking to an adviser before they join. The Generate KiwiSaver Scheme manages three funds and has over $2.6 billion total Assets Under Management as per the Generate KiwiSaver Scheme Annual Report from March 2021.

During September, the share market and, consequently, Generate KiwiSaver returns decreased. The decrease could be due to Auckland’s lockdown, the market calming down after last year's considerable returns or another external factor. However, the returns are not something to worry about as it is natural for the market to sway, and the fluctuation does not indicate the performance of these funds in the long term.

Table of Contents

News about Generate

Performance of Generate KiwiSaver Funds

Generate Conservative Fund

Generate Growth Fund

Generate Focused Growth Fund

News about Generate

Generate has won a number of awards including the Outstanding Collaboration Award at the 2021 Sustainable Business Awards with along with their partner Community Finance, the Advisers’ Choice Award for KiwiSaver at the Research IP Fund Manager of the Year Awards 2021, and the Gold in the 2022 Reader’s Digest Quality Service Awards, in the Superannuation category.

Performance of Generate KiwiSaver Funds

|

1 month |

1 year |

3 years |

5 years |

Since Inception |

|

|

Conservative |

-0.64% |

3.22% |

6.51% |

6.22% |

5.97% |

|

Growth |

-1.66% |

10.07% |

11.67% |

11.54% |

9.93% |

|

Focused Growth |

-1.55% |

11.52% |

12.91% |

13.05% |

10.8% |

Sourced from Generate fund performance report

* These returns are to the 30th of November 2021 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Generate Quarterly Fund updates published on the 29th of October.

Generate Conservative Fund

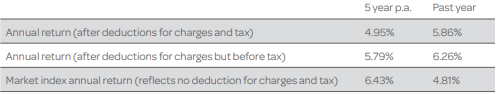

The objective of the Conservative Fund is to provide a low volatility fund with conservative returns through investing in a portfolio of predominantly fixed interest, with some actively managed cash, property, and equities. The fund has a low to medium level of volatility. The 1-month negative return was -0.64%, and the 1-year return is 3.22% which is lower than the since inception return of 5.97%.

*The following is Sourced from Generate Conservative Fund Update

Returns

Fees

The total annual fees for investors in the Generate Conservative fund are 1.21% per year.

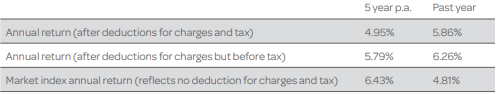

Investment mix

The investment mix shows the type of assets that the fund invests into.

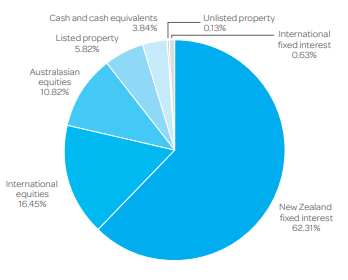

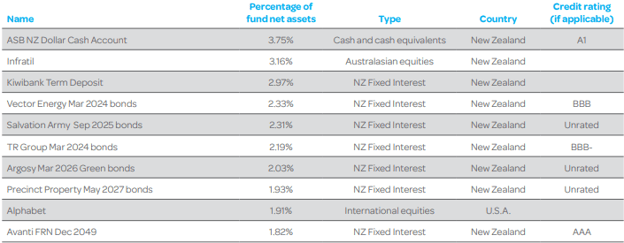

Top ten investments

This table shows Generate’s top 10 investments in the Conservative KiwiSaver fund, which make up 24.40% of the fund.

Generate Growth Fund

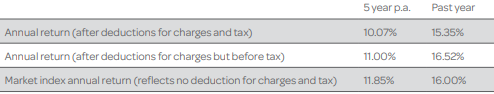

The objective of the Growth Fund is to provide a medium to a high level of volatility growth investment return over the long-term through investment in a portfolio of actively managed cash, fixed interest, property, and a majority of the portfolio being equities. The 1-month negative returns were -1.66%, and the 1-year return of 10.07% which is slightly above the since inception return of 9.93%.

*The following is Sourced from Generate Growth Fund Update

Returns

Fees

The total annual fees for investors in the Generate Growth fund are 1.42% per year.

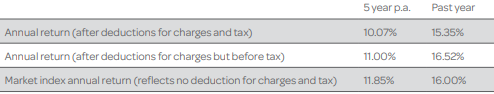

Investment mix

The investment mix shows the type of assets that the fund invests into.

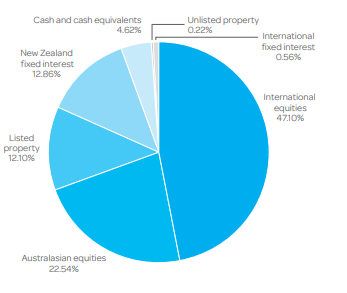

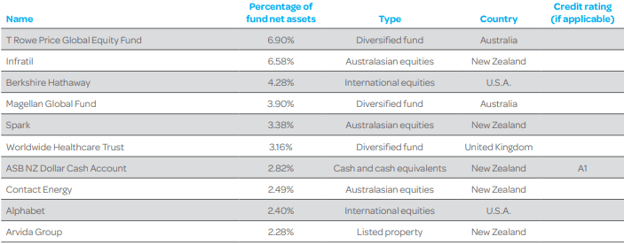

Top ten investments

This table shows Generate’s top 10 investments in the Growth KiwiSaver fund, which make up 38.19% of the fund.

Generate Focused Growth Fund

The objective of the Focused Growth Fund is to provide a growth investment return over the long-term through investment in a portfolio of actively managed cash, fixed interest, property, with a large allocation of Australasian equities and international equities. The fund has a higher level of volatility than the Growth fund. The fund has had a 1-month return of -1.55%, and a 1-year return of 11.52%, which like the growth fund is higher than the since inception return of 10.06%.

*The following is Sourced from Generate Focused Growth Fund Update

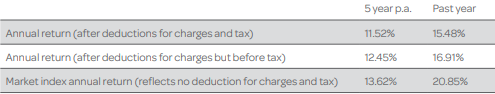

Returns

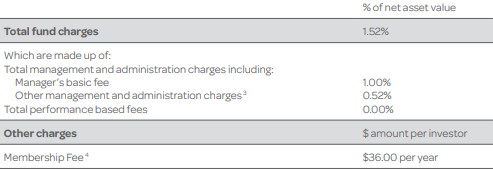

Fees

The total annual fees for investors in the Generate Focused Growth fund are 1.52% per year.

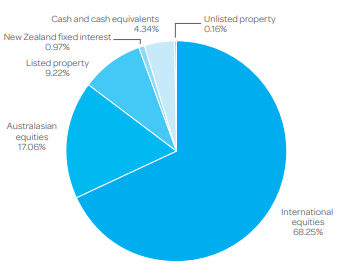

Investment mix

The investment mix shows the type of assets that the fund invests into.

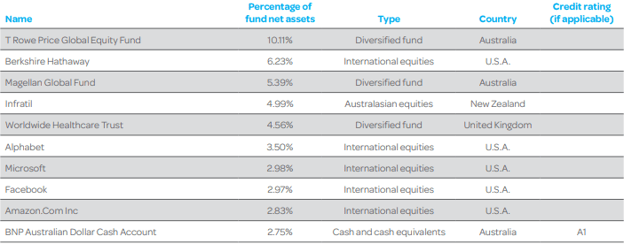

Top ten investments

This table shows Generate’s top 10 investments in the Focused Growth KiwiSaver fund, which make up 46.31% of the fund.

Data for Generate KiwiSaver funds have been sourced from Generate KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Generate has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.