Using the most recent returns and fund update reports from May 2022, we will examine BNZ’s recent KiwiSaver Performance.

The Bank of New Zealand (BNZ) has been helping Kiwis establish healthy money management practices since 1861. Low costs, a wide range of fund selections, and ethical investing alternatives are all part of the BNZ KiwiSaver program's commitment to its current 186,668 clients. There are six funds managed by the BNZ KiwiSaver Scheme, with a combined asset under management of NZ$3.6 billion.

During the first week of May, a global sell-off commenced, led by U.S. technology firms, which recorded their largest one-day fall since June 2020. Investors across the world are frightened by high inflation and rising interest rates after the US Federal Reserve's decision to increase interest rates by 0.50% compared to its prior projection, putting pressure on other central banks around the world to perform aggressive hikes to combat inflation.

Table of Contents

Performance of BNZ KiwiSaver Funds

BNZ Cash Fund

BNZ First Home Buyer Fund

BNZ Conservative Fund

BNZ Moderate Fund

BNZ Balanced Fund

BNZ Growth Fund

Performance of BNZ KiwiSaver Funds

|

1 month |

3 months |

1 year |

3 years |

5 years |

Since Inception |

|

|

Cash |

0.07% |

0.20% |

0.52% |

0.92% |

1.50% |

2.13% |

|

First Home Buyer |

-1.26% |

-2.27% |

-2.24% |

1.34% |

2.35% |

2.88% |

|

Conservative |

-2.49% |

-4.66% |

-5.29% |

0.89% |

2.37% |

3.75% |

|

Moderate |

-2.96% |

-5.21% |

-4.91% |

2.91% |

4.18% |

5.38% |

|

Balanced |

-3.38% |

-5.64% |

-4.53% |

4.47% |

5.62% |

6.74% |

|

Growth |

-3.58% |

-5.64% |

-3.59% |

6.39% |

7.42% |

8.38% |

Sourced from BNZ fund performance report

* These returns are to 30 April 2022 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from BNZ Quarterly Fund updates published on 29 April 2022

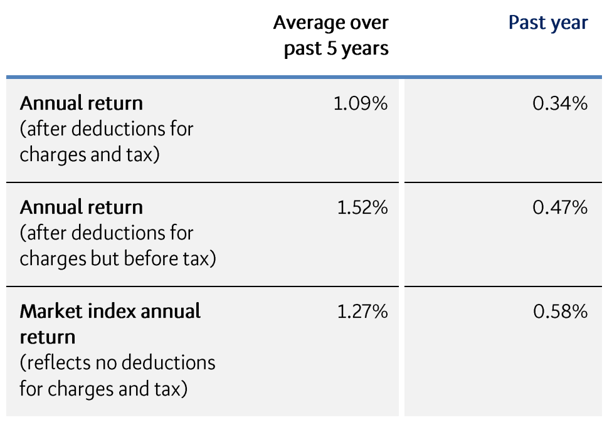

BNZ Cash Fund

The Cash Fund primarily invests in cash and cash equivalents. The Cash Fund seeks to achieve consistent returns over the short term. The Cash Fund has had a 1-month return of 0.06%, and a 1-year return of 1.01%, both of which are lower since the inception return of 2.16%.

*The following is Sourced from BNZ Cash Fund Update

Returns

Fees

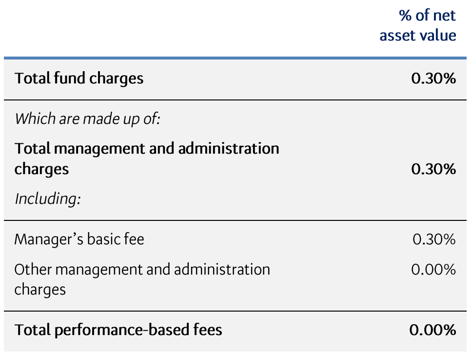

The total annual fees for investors in the BNZ Cash Fund are 0.30% per year.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a cash fund.

Top ten investments

This table shows BNZ’s top 10 investments in the Cash Fund, which make up 30.81% of the fund.

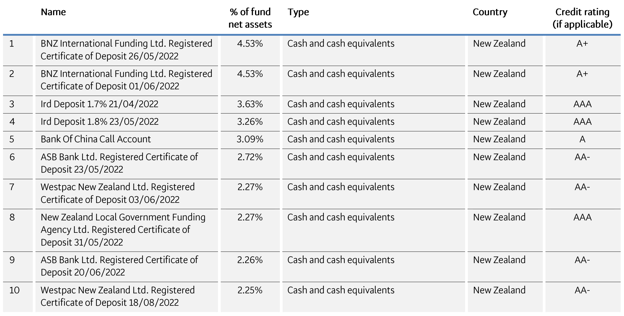

BNZ First Home Buyer Fund

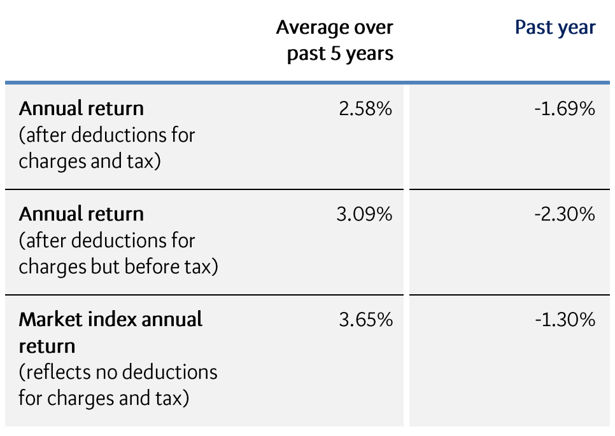

The BNZ First Home Buyer Fund aims to provide exposure to a portfolio of income assets, which generally have lower levels of risk. Therefore, the objective is to achieve stable returns over the short to medium term. The First Home Buyer Fund has a 1-month return of -0.29% and a 1-year return of -0.62% lower than the inception return of 2.14%.

*The following is Sourced from BNZ First Home Buyer Fund Update

Returns

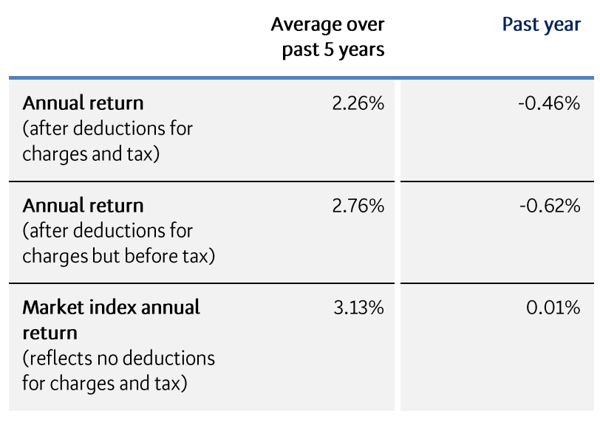

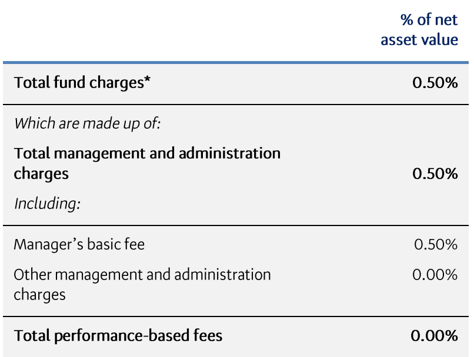

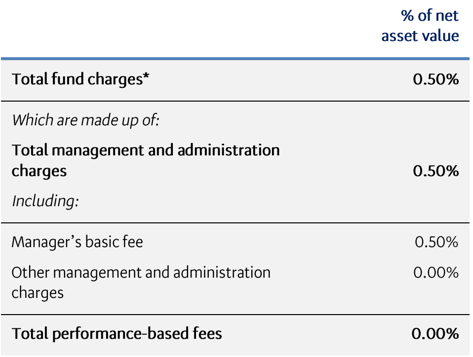

Fees

The total annual fees for investors in the BNZ First Home Buyer Fund are 0.50% per year.

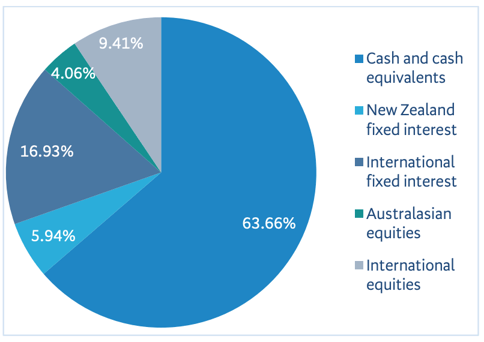

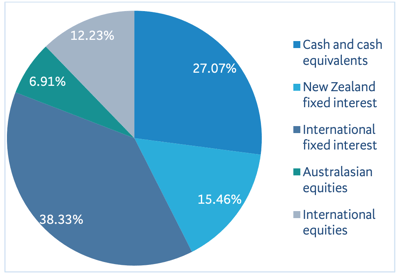

Investment mix

The investment mix shows the type of assets that the fund invests into.

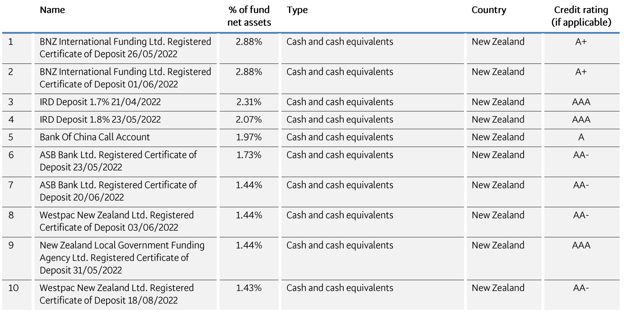

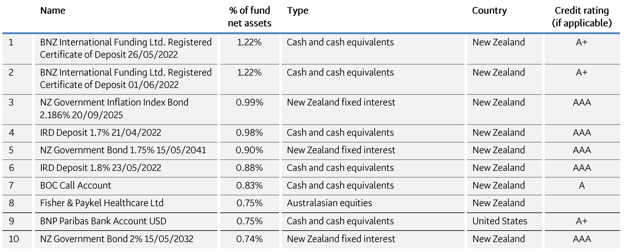

Top ten investments

This table shows BNZ’s top 10 investments in the First Home Buyer Fund, which make up 19.59% of the fund.

BNZ Conservative Fund

The BNZ Conservative Fund aims to provide exposure to a portfolio of income assets, which generally have lower levels of risk. Therefore, the objective to achieve relatively stable returns over the short to medium term. The Conservative Fund has a 1-month return of -0.88% and a 1-year return of -2.30% lower than the since inception return of 4.07%.

*The following is Sourced from BNZ Conservative Fund Update

Returns

Fees

The total annual fees for investors in the BNZ Conservative Fund are 0.50% per year.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows BNZ’s top 10 investments in the Conservative Fund, which make up 9.26% of the fund.

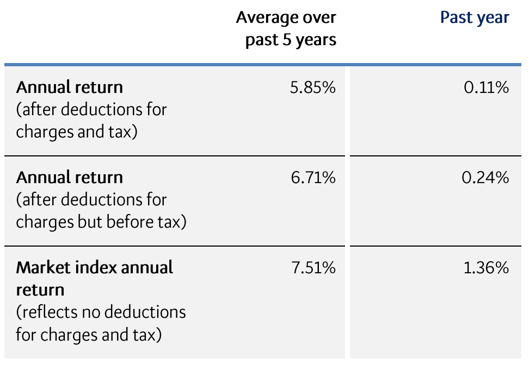

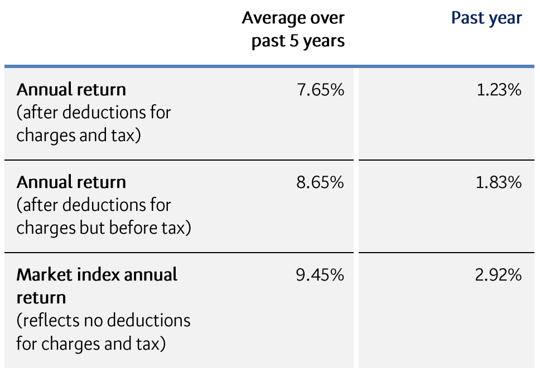

BNZ Moderate Fund

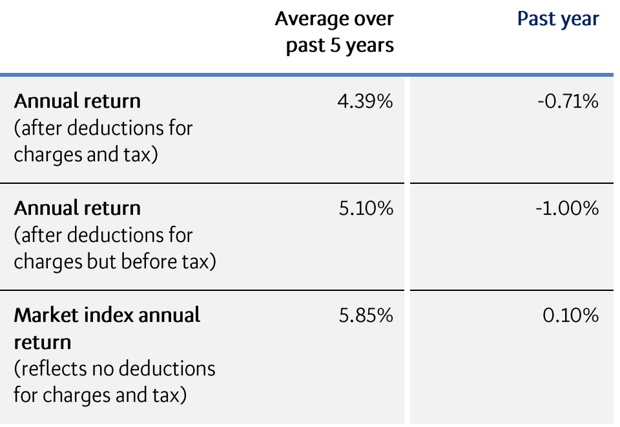

The BNZ Moderate Fund aims to provide exposure to a portfolio of income assets, which generally have lower levels of risk. Therefore, the objective is to achieve relatively medium returns over the medium term. The Moderate Fund has a 1-month return of -0.51% and a 1-year return of -1.00% lower than the since inception return of 5.78%.

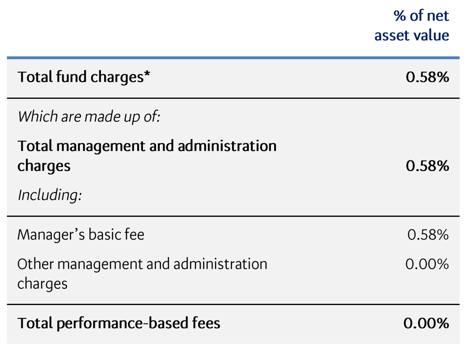

*The following is Sourced from BNZ Moderate Fund Update

Returns

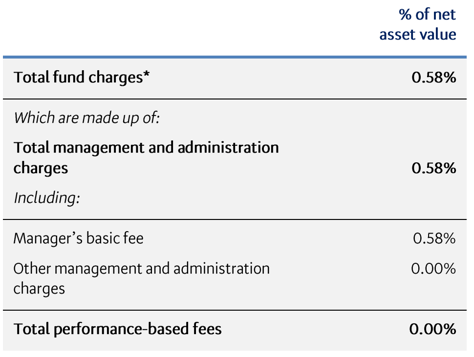

Fees

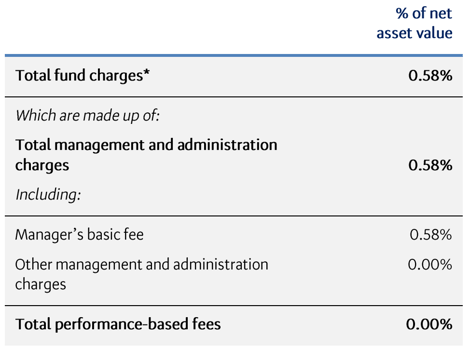

The total annual fees for investors in the BNZ Moderate Fund are 0.58% per year.

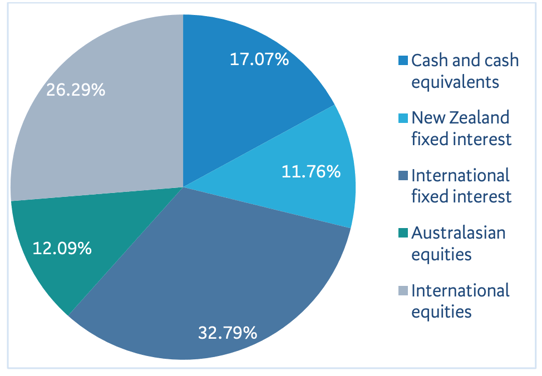

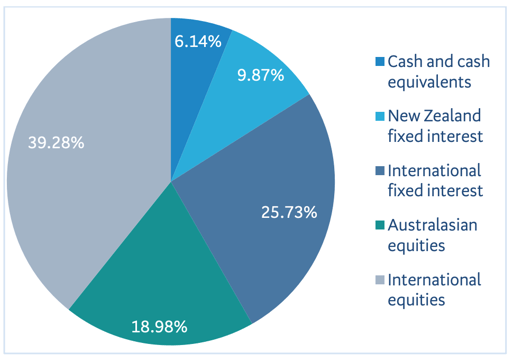

Investment mix

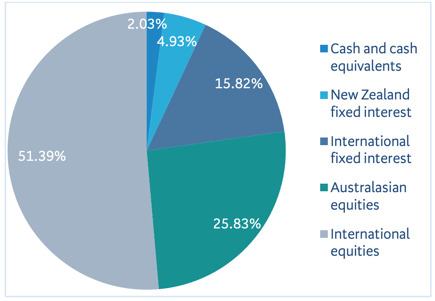

The investment mix shows the type of assets that the fund invests into.

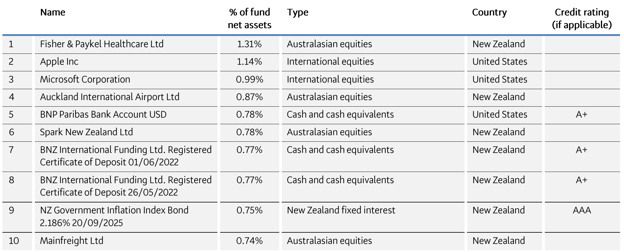

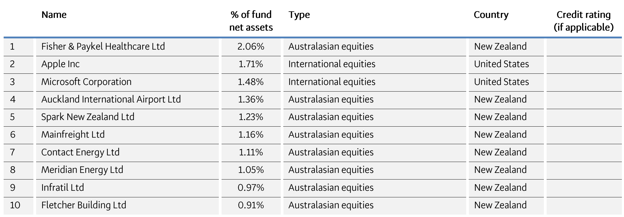

Top ten investments

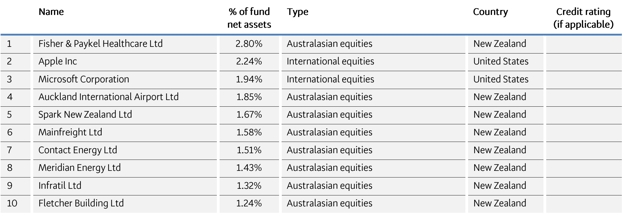

This table shows BNZ’s top 10 investments in the Moderate Fund, which make up 8.90% of the fund.

BNZ Balanced Fund

The BNZ Balanced Fund aims to provide exposure to a portfolio of sizable allocation to income assets. Therefore, the objective to achieve a medium returns over the medium to long-term. The Balanced Fund has a 1-month return of -0.14% and a 1-year return of 0.24% lower than the since inception return of 7.21%.

*The following is Sourced from BNZ Balanced Fund Update

Returns

Fees

The total annual fees for investors in the BNZ Balanced Fund are 0.58% per year.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows BNZ’s top 10 investments in the Balanced Fund, which make up 13.04% of the fund.

BNZ Growth Fund

The BNZ Growth Fund aims to provide exposure to a portfolio of mostly growth assets. Therefore, the objective is to achieve higher returns over the long term. The Growth Fund has a 1-month return of 0.34% and a 1-year return of 1.83% lower than the since inception return of 8.89%.

*The following is Sourced from BNZ Growth Fund Update

Returns

Fees

The total annual fees for investors in the BNZ Growth Fund are 0.58% per year.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows BNZ’s top 10 investments in the Growth Fund, which make up 17.58% of the fund.

Data for BNZ KiwiSaver funds have been sourced from BNZ KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if BNZ has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.