With Covid-19 stabilizing and lock-down coming to an end, it’s time to take a look at ASB and how it has affected KiwiSaver Investors. We will be going over the most recent data and seeing if it has made much difference and see what we are investing in.

Important News for the ASB KiwiSaver Scheme

ASB has announced that in October of 2021, they will be removing the monthly admission fees charged on the ASB KiwiSaver Scheme.

This is great news for Kiwis looking to move to a low cost provider and will insure more money will go into customers pockets.

Performance of ASB KiwiSaver Funds as of August 31st

As shown below, over the past year ASB’s KiwiSaver funds have been performing above their long term average, excluding the Conservative and NZ Cash Fund. These returns show the upswing from 2020’s Covid-19 lock-down. With the introduction of the Delta variant, we may continue to see some volatility within the next few months.

|

(excluding the Administration Fee) |

1 Year |

5 Years (p.a) |

Since Launch (p.a) |

Positive Impact Fund |

17.38% |

- |

10.99% |

Growth Fund |

16.53% |

10.28% |

7.02% |

Balanced Fund |

11.34% |

8.41% |

6.57% |

Moderate Fund |

6.18% |

5.90% |

5.77% |

Conservative Fund |

2.63% |

4.49% |

5.18% |

NZ Cash Fund |

0.24% |

1.45% |

2.85% |

You can see how they compare with other providers or view a list of best KiwiSaver funds here.

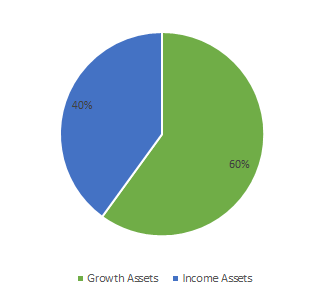

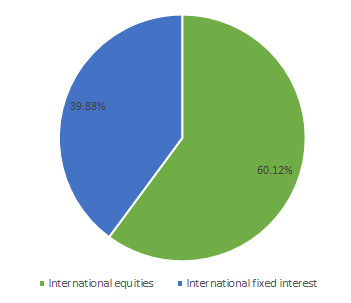

Positive Impact Fund

The goal of ASB’s Positive Impact Fund is to invest into more growth assets than income assets (60% and 40%). This means that by choosing to invest in the Positive Impact Fund, you need to expect large amounts of volatility over time. This includes an annual fee of 1.00%.

This is a great choice for Kiwis looking long-term, and want to invest their KiwiSaver savings into something that has a positive impact. Over this past year, it has had a return of 17.38% showing the highest return from the funds. It includes companies that are addressing the world’s social and environmental issues such as Clean energy infrastructure, Climate or environmental projects, Affordable housing, and clean water and sanitation.

Investments Include:

|

% of Fund net Assets |

Type |

Country |

|

|

Vanguard Ethically Conscious Global Bond Index Fund NZD Hdgd |

38.68% |

International fixed interest |

Australia |

|

Mercer Socially Responsible Overseas Shares Portfolio |

29.09% |

International equities |

New Zealand |

|

Mercer Socially Responsible Hedged Overseas Shares Portfolio |

29.01% |

International equities |

New Zealand |

|

ASB Bank Account NZD |

3.22% |

Cash and cash equivalents |

New Zealand |

What has the fund invested in?

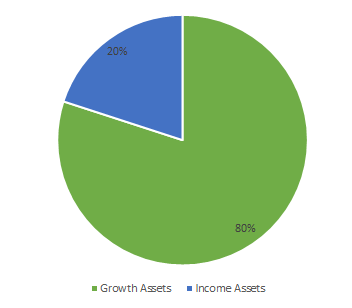

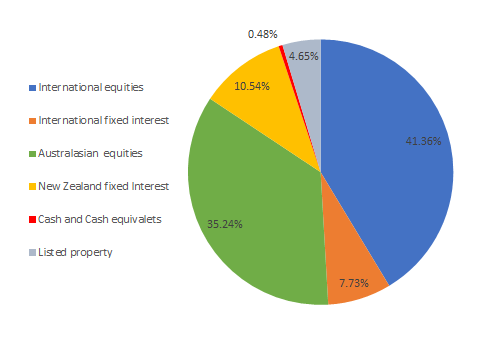

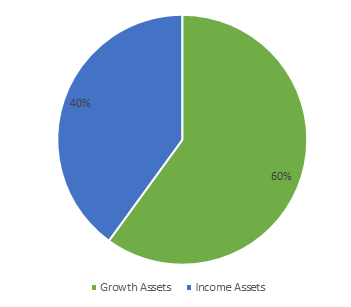

Growth Fund

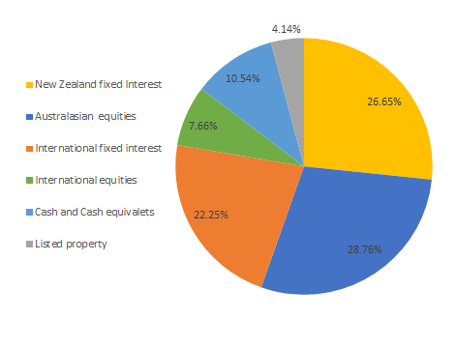

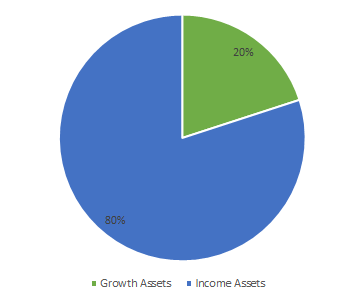

The goal for ASB’s Growth Fund is also to invest into a high proportion of growth assets over income assets (80% to 20%), and aims for high total returns over time. This will mean that there is expected to be some years with negative returns.

With the past year's returns being 16.53%, this is another great choice for Kiwis looking for a long-term KiwiSaver scheme.

Investments Include:

|

% of Fund net Assets |

Type |

Country |

|

|

Fisher & Paykel Healthcare Corporation Ltd |

2.92% |

Australasian equities |

New Zealand |

|

ASB Bank Account NZD |

1.90% |

Cash and cash equivalents |

New Zealand |

|

Spark New Zealand Ltd |

1.45% |

Australasian equities |

New Zealand |

|

Auckland International Airport Ltd |

1.43% |

Australasian equities |

New Zealand |

|

Apple Inc |

1.40% |

International equities |

United States |

What has the fund invested in?

Annual Fund Charge: 0.70%

Balanced Fund

The aim of ASB’s Balanced Fund is to invest more in growth assets than income assets (60% to 40%). Again, ups and downs are expected with this fund. This comes with an annual fund charge of 0.65%.

The balanced funds are great for Kiwis that are looking to use their savings earlier, with a minimum suggested time frame of 6 years.

Investments Include:

|

% of Fund net Assets |

Type |

Country |

|

|

Fisher & Paykel Healthcare Corporation Ltd |

2.63% |

Australasian equities |

New Zealand |

|

ASB Bank Account NZD |

2.03% |

Cash and cash equivalents |

New Zealand |

|

Westpac Money Market Deposit Account NZD |

2.01% |

Cash and cash equivalents |

New Zealand |

|

Spark New Zealand Ltd |

1.31% |

Australasian equities |

New Zealand |

|

Auckland International Airport Ltd |

1.28% |

Australasian equities |

New Zealand |

What has the fund invested in?

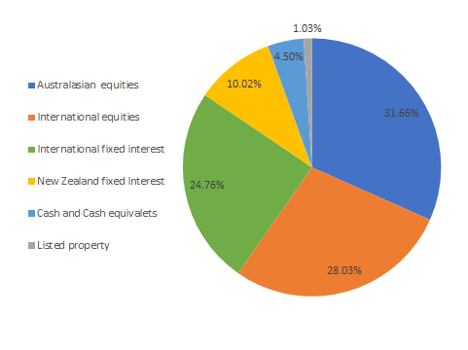

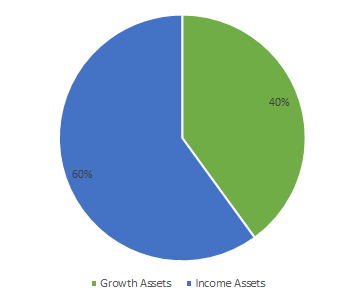

Moderate Fund

ASB’s Moderate Fund looks to invest less into growth funds over the income assets (40% to 60%), this has been different from the previous funds. This comes with an annual fee of 0.60%.

This is a good fund to choose for those looking to save for a shorter amount of time, minimum 3 years, with moderate returns.

Investments Include:

|

% of Fund net Assets |

Type |

Country |

|

|

Westpac Money Market Deposit Account NZD |

4.69% |

Cash and cash equivalents |

New Zealand |

|

Fisher & Paykel Healthcare Corporation Ltd |

2.38% |

Australasian equities |

New Zealand |

|

ASB Bank Account NZD |

2.25% |

Cash and cash equivalents |

New Zealand |

|

Certificate of Deposit RCD ASB Bank 26/08/2021 |

1.64% |

Cash and cash equivalents |

New Zealand |

|

New Zealand Government 5.5 15/04/2023 |

1.58% |

New Zealand fixed interest |

New Zealand |

What has the fund invested in?

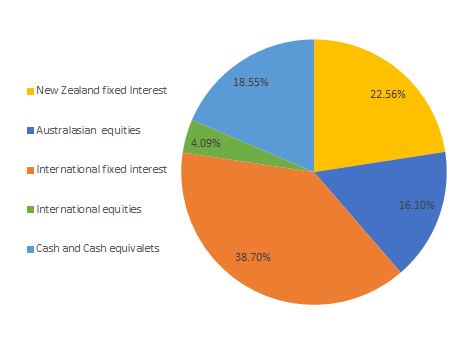

Conservative Fund

The Conservative Fund aims for the LOW proportion of growth assets and a HIGH proportion on income assets(20% to 80%). This has moderate volatility compared to the previous funds, but still higher than the NZ Cash Fund.

This fund is for those who are looking for modest returns in their savings, as we see with the return of 2.63% for the past year. Great for short-term saving. The annual fee for Conservative is 0.40%.

Investments Include:

|

% of Fund net Assets |

Type |

Country |

|

|

Westpac Money Market Deposit Account NZD |

8.29% |

Cash and cash equivalents |

New Zealand |

|

Certificate of Deposit RCD ASB Bank 26/08/2021 |

2.90% |

Cash and cash equivalents |

New Zealand |

|

Certificate of Deposit RCD ASB Bank 10/09/2021 |

2.41% |

Cash and cash equivalents |

New Zealand |

|

Certificate of Deposit RCD ASB Bank 19/08/2021 |

2.32% |

Cash and cash equivalents |

New Zealand |

|

ASB Bank Account NZD |

2.23% |

Cash and cash equivalents |

New Zealand |

What has the fund invested in?

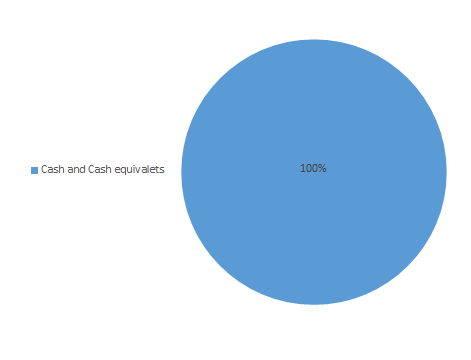

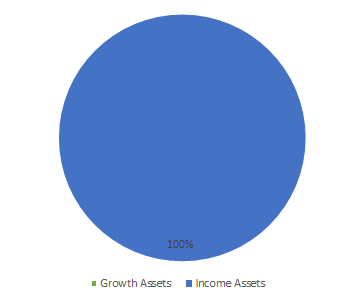

NZ Cash Fund

As the name suggests, ASB’s NZ Cash Fund invests 100% of their assets into income assets. This comes with a low chance of a negative return, but also with low returns, as seen last year with a 0.24% return.

The NZ Cash Fund is great for providing exposure to portfolio investment grade short-term deposits. This fund generally has the least number of negative returns out of all the funds. The annual fund charge being 0.35%.

Investments Include:

|

% of Fund net Assets |

Type |

Country |

|

|

Westpac Money Market Deposit Account NZD |

44.11% |

Cash and cash equivalents |

New Zealand |

|

Certificate of Deposit RCD ASB Bank 26/08/2021 |

15.41% |

Cash and cash equivalents |

New Zealand |

|

Certificate of Deposit RCD ASB Bank 10/09/2021 |

12.84% |

Cash and cash equivalents |

New Zealand |

|

Certificate of Deposit RCD ASB Bank 19/08/2021 |

12.35% |

Cash and cash equivalents |

New Zealand |

|

Certificate of Deposit RCD ASB Bank 28/09/2021 |

11.72% |

Cash and cash equivalents |

New Zealand |

What has the fund invested in?