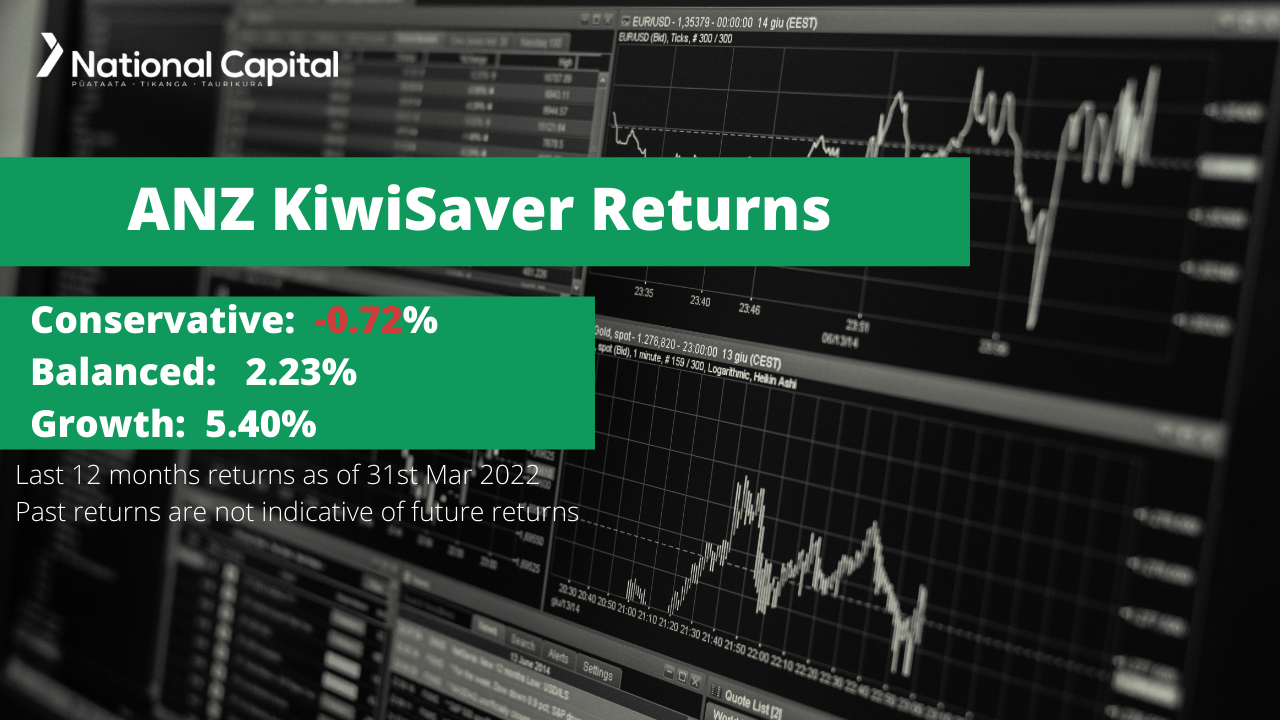

Using the most recent returns and fund update reports from December 2021, we will examine ANZ’s recent KiwiSaver Performance.

ANZ is one of New Zealand’s leading banking and financial services groups. They are one of the world’s largest banks serving more than 5 million customers. ANZ is also the largest KiwiSaver provider in New Zealand, with more than 650,000 members in their KiwiSaver scheme.

During the fourth quarter of 2021, the global equity markets ended the year with a strong note despite concerns around the Omicron variant of Covid-19. On the other hand, bond markets struggled with the remaining concerns of inflation and rising interest rates.

Table of Contents

Performance of ANZ KiwiSaver Funds

ANZ Conservative Balanced Fund

News about ANZ

The situation in Ukraine is evolving and things are changing quickly, so investors should expect ongoing volatility in financial markets. Despite the markets’ sharp fall on news of Russia’s invasion of Ukraine, they have since recovered some of their losses. With Russia being a key exporter of oil, gas, and other commodities, broad-based sanctions can potentially impact supply chains, which could worsen inflationary pressures.

Performance of ANZ KiwiSaver Funds

|

3 months |

1 year |

3 years |

5 years |

10 years |

Since Inception |

|

|

Cash |

0.18% |

0.59% |

1.09% |

1.57% |

2.27% |

2.53% |

|

Conservative |

-4.00% |

-0.72% |

3.40% |

3.80% |

4.98% |

5.01% |

|

Conservative Balanced |

-4.39% |

0.88% |

5.15% |

5.29% |

6.55% |

5.78% |

|

Balanced |

-4.84% |

2.23% |

6.67% |

6.63% |

8.00% |

6.43% |

|

Balanced Growth |

-5.23% |

3.89% |

8.29% |

8.02% |

9.48% |

7.03% |

|

Growth |

-5.66% |

5.40% |

9.81% |

9.32% |

10.86% |

7.51% |

Sourced from ANZ fund performance report

*These returns are to 31 March 2022 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from ANZ Quarterly Fund updates published on 14 February 2022.

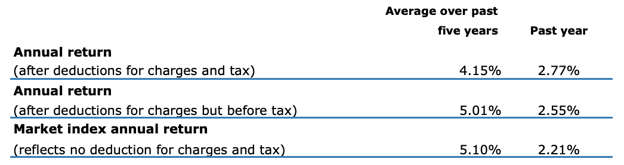

ANZ Cash Fund

The Cash Fund invests mainly in cash and cash equivalents which may include investments issued by New Zealand-registered banks, the New Zealand Government, corporate or local authorities, or non-New Zealand governments. The Fund aims to achieve a yearly return in line with the relevant market index. The Cash Fund has had a 3-months return of 0.18%, a 1-year return of 0.59% and a since inception return of 2.53%.

*The following is Sourced from ANZ Cash Fund Update

Returns

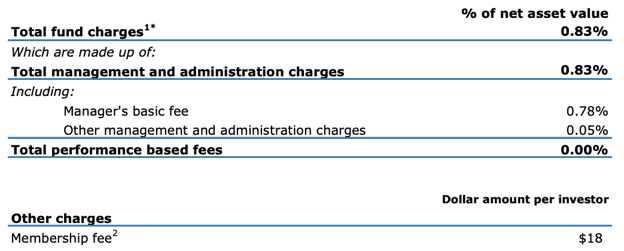

Fees

The total annual fees for investors in the ANZ Cash Fund are 0.23% per year.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a Cash Fund.

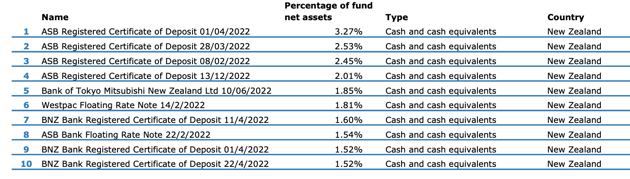

Top ten investments

This table shows ANZ’s top 10 investments in the Cash KiwiSaver Fund, which make up 20.10% of the fund.

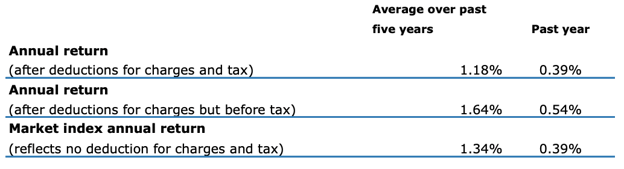

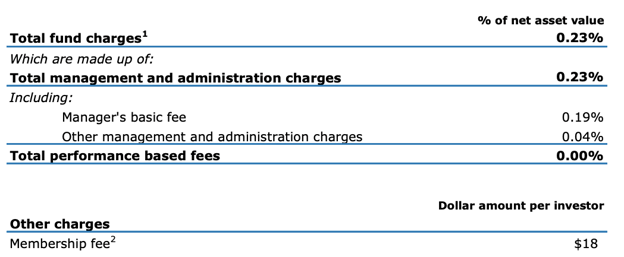

ANZ Conservative Fund

The Conservative Fund invests mainly in income assets (cash and cash equivalents and fixed interest) with a smaller proportion of growth assets (equities, listed property and listed infrastructure). This fund might be suitable for investors with low volatility. The Conservative Fund has had a 3-months return of -4.00%, a 1-year return of -0.72%, and a since inception return of 5.01%.

*The following is Sourced from ANZ Conservative Fund Update

Returns

Fees

The total annual fees for investors in the ANZ Conservative Fund are 0.61% per year because the manager’s basic fee was reduced from 0.78% to 0.56%.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows ANZ’s top 10 investments in the Conservative KiwiSaver Fund, which make up 7.33% of the fund.

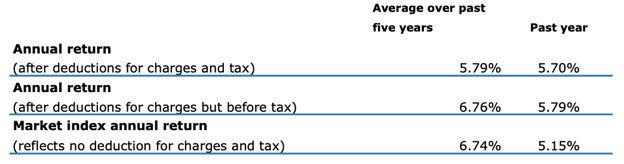

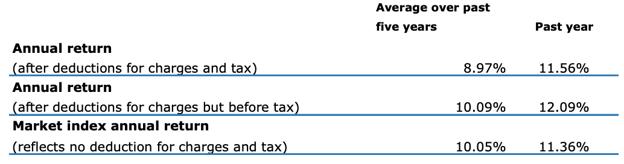

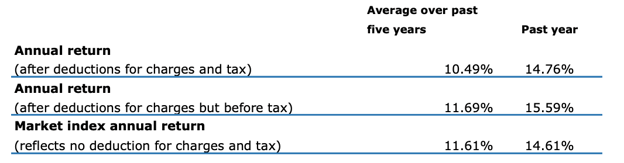

ANZ Conservative Balanced Fund

The Conservative Fund invests mainly in income assets (cash and cash equivalents and fixed interest), with some proportion of growth assets (equities, listed property and listed infrastructure). This Fund is intended for investors with low volatility. The Conservative Balanced Fund has had a 3-months return of -4.39%, a 1-year return of 0.88% and a since inception return of 5.78%.

*The following is Sourced from ANZ Conservative Balanced Fund Update

Returns

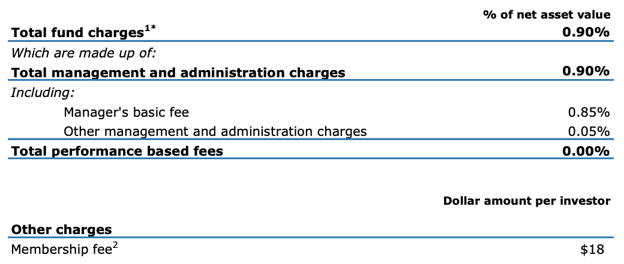

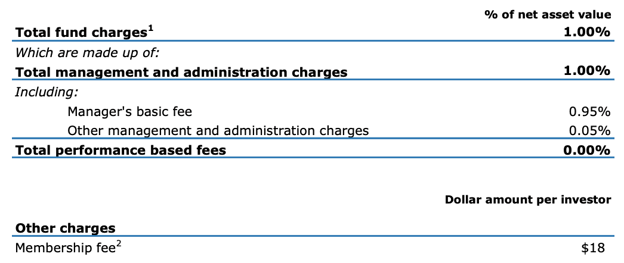

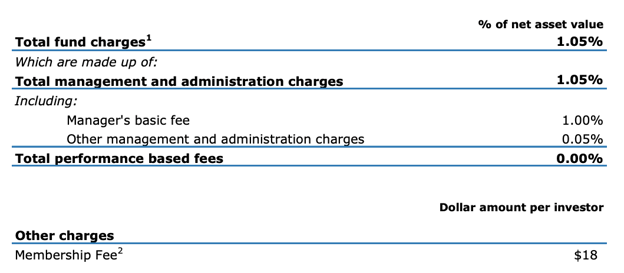

Fees

The total annual fees for investors in the ANZ Conservative Balanced Fund are 0.75% per year because the manager’s basic fee was reduced from 0.85% to 0.70%.

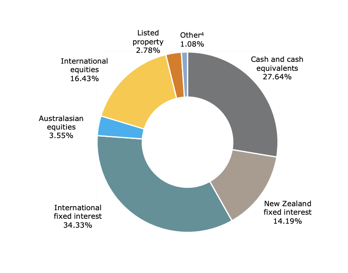

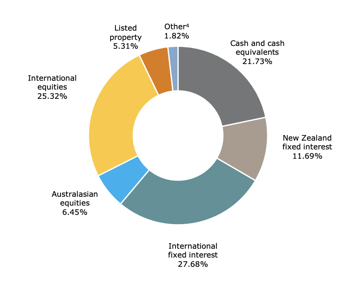

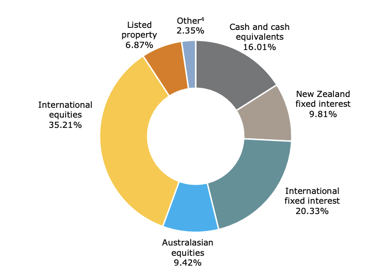

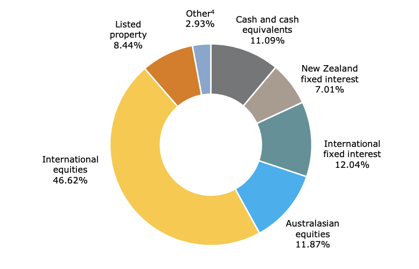

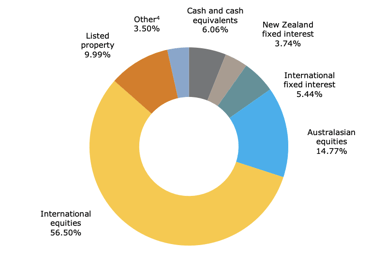

Investment mix

The investment mix shows the type of assets that the fund invests into.

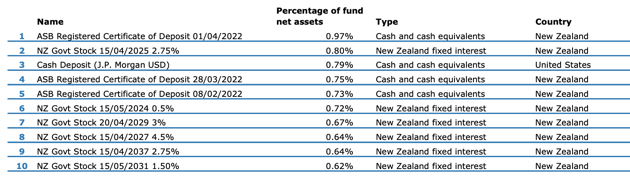

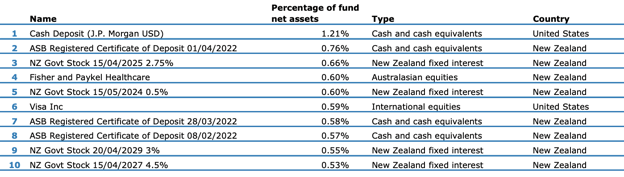

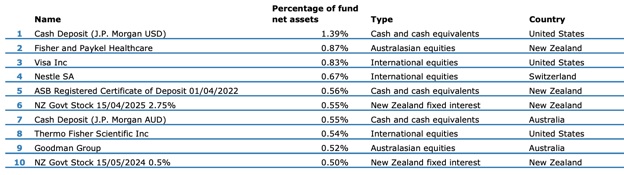

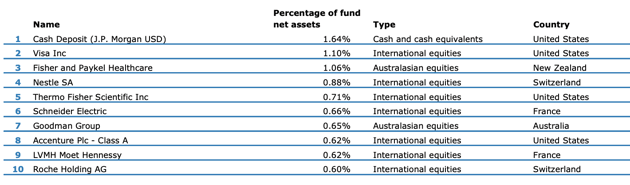

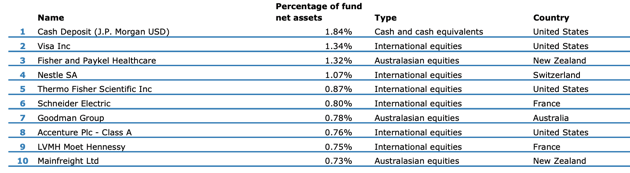

Top ten investments

This table shows ANZ’s top 10 investments in the Conservative Balanced KiwiSaver Fund, which make up 6.65% of the fund.

ANZ Balanced Fund

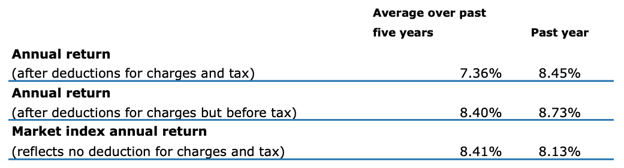

The Balanced Fund invests in a similar proportion of income assets (cash and cash equivalents and fixed interest) and growth assets (equities, listed property and listed infrastructure). This fund is intended for investors with balanced volatility tolerance. The Balanced Fund has had a 3-months return of -4.84%, a 1-year return of 2.23% and a since inception return of 6.43%.

*The following is Sourced from ANZ Balanced Fund Update

Returns

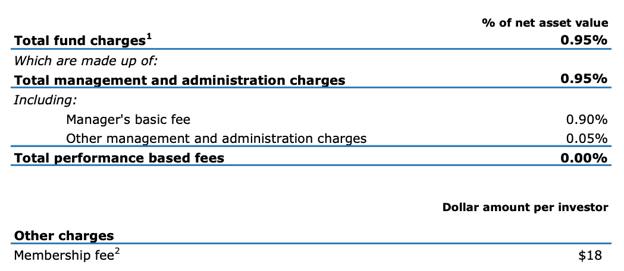

Fees

The total annual fees for investors in the ANZ Balanced Fund are 0.95% per year.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows ANZ’s top 10 investments in the Balanced KiwiSaver Fund, which make up 6.98% of the fund.

ANZ Balanced Growth Fund

The Balanced Growth Fund invests primarily in growth assets (equities, listed property and listed infrastructure), with some proportion of income assets (cash and cash equivalents and fixed interest). This fund is intended for investors with higher volatility tolerance than balanced but lower than growth. The Balanced Growth Fund has had a 3-months return of -5.23%, a 1-year return of 3.89% and a since inception return of 7.03%.

*The following is Sourced from ANZ Balanced Growth Fund Update

Returns

Fees

The total annual fees for investors in the ANZ Balanced Growth Fund are 1% per year.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows ANZ’s top 10 investments in the Balanced Growth KiwiSaver Fund, which make up 8.54% of the fund.

ANZ Growth Fund

The Growth Fund invests primarily in growth assets (equities, listed property and listed infrastructure), with a smaller proportion of income assets (cash and cash equivalents and fixed interest). This fund is aimed at investors with high volatility tolerance as this is the highest volatility fund from ANZ KiwiSaver. The Growth Fund has had a 3-month return of -5.66%, a 1-year return of 5.40% and a since inception return of 7.51%.

*The following is Sourced from ANZ Growth Fund Update

Returns

Fees

The total annual fees for investors in the ANZ Growth Fund are 1.05% per year.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows ANZ’s top 10 investments in the Growth KiwiSaver Fund, which make up 10.26% of the fund.

Data for ANZ KiwiSaver funds has been sourced from ANZ KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if ANZ has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.