Using the most recent returns and fund update reports from December 2021, We will be examining AMP KiwiSaver Performance by taking a look at the latest news, information, fees, fund investments, and data, such as fund performance and returns.

AMP Investment Management was founded in 1849. The AMP Group includes AMP Capital and AMP Wealth Management, and they have a nearly 170-year history together. AMP Capital employs over 250 investment professionals in 19 locations across 19 countries globally. As of March 2021, their KiwiSaver scheme had $6.5 billion in AUM and 216,311 members. AMP is now the fourth largest KiwiSaver provider.

In December, the stock markets shrugged off the threat of the new 'Omicron' Covid wave. This new wave of "Omicron" at the end of 2021 caused some drops in fund returns. While the Omicron wave is expected to slow growth this year, a global recession is unlikely. Businesses should benefit from moderate economic growth so the KiwiSaver investors shouldn't be concerned about one negative month yet focus on the long-term returns. This year, the market is likely to be very volatile. When prices go up and down, it can be stressful, but we can see this volatility as an opportunity to outperform the markets. Investors should focus on long-term investment goals despite the volatility and not get distracted by short-term gains.

Table of Contents

Recent AMP KiwiSaver News

Performance of AMP KiwiSaver Funds

AMP KiwiSaver Cash Fund

AMP KiwiSaver Conservative Fund

AMP KiwiSaver Moderate Fund

AMP KiwiSaver Moderate Balanced Fund

AMP KiwiSaver Balanced Strategy

AMP KiwiSaver Growth Fund

AMP KiwiSaver Aggressive Fund

Recent AMP KiwiSaver News

AMP Wealth Management reported an 11% increase in net profit after tax to $42 million for the year ended December 31 but forecasts a lower profit next year. Furthermore, AMP lost approximately $1 billion in assets under management when it lost its KiwiSaver default status, but gains in strong investment markets mitigated the net result.

Performance of AMP KiwiSaver Funds

|

3 months |

1 year |

3 years |

5 years |

10 years |

Since Inception |

|

|

Cash Fund |

0.04% |

-0.07% |

0.56% |

0.96% |

1.82% |

1.82% |

|

Conservative Fund |

0.44% |

1.91% |

4.87% |

4.27% |

4.75% |

4.75% |

|

Moderate Fund |

0.97% |

4.04% |

6.63% |

5.53% |

5.90% |

5.90% |

|

Moderate Balanced Fund |

1.78% |

6.05% |

8.15% |

6.60% |

6.90% |

6.90% |

|

Balanced Fund |

2.06% |

8.03% |

9.71% |

7.70% |

7.87% |

7.87% |

|

Growth Fund |

3.02% |

11.83% |

12.49% |

9.66% |

9.49% |

9.49% |

|

Aggressive Fund |

3.42% |

13.64% |

13.46% |

10.38% |

10.31% |

10.31% |

*Sourced from AMP fund performance report

AMP KiwiSaver Cash Fund

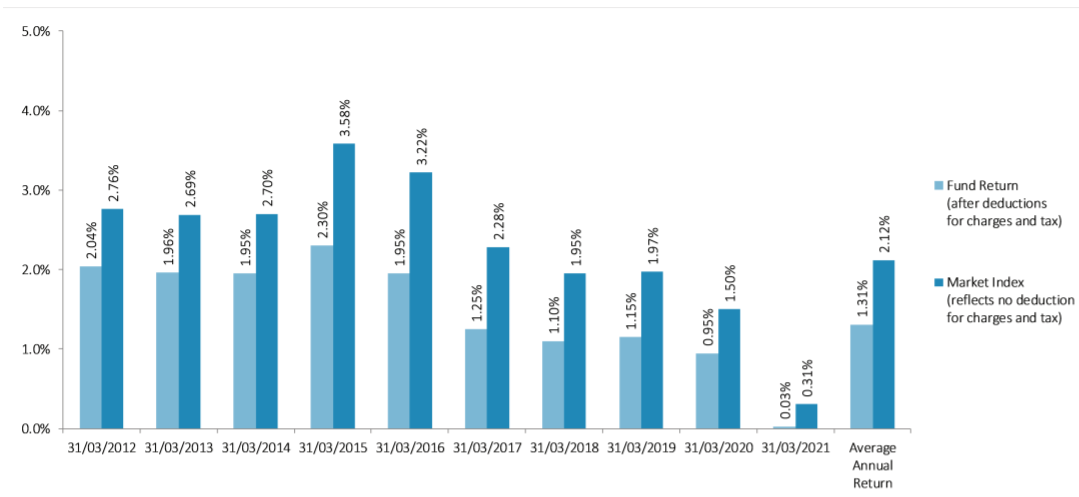

The Cash Fund invests mainly in cash and short-term deposits to achieve modest, stable returns with lowest volatility. The Cash Fund saw a 3-month return of 0.04% and a low 1-year return of -0.07% lower than the since inception return of 1.82%.

*The following is Sourced from AMP Cash Fund Update

Returns

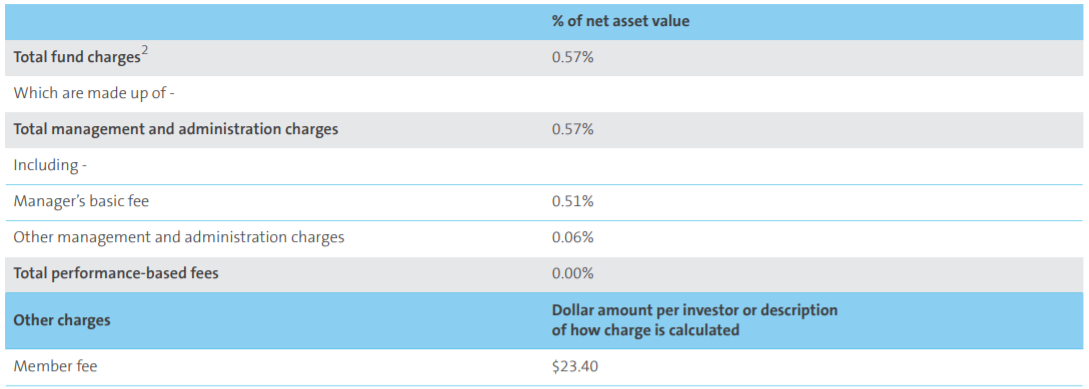

Fees

The annual estimated fee for investors in the Cash fund is 0.57%.

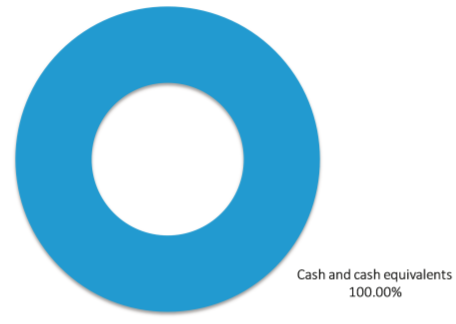

Investment mix

The investment mix shows the type of assets that the fund invests into.

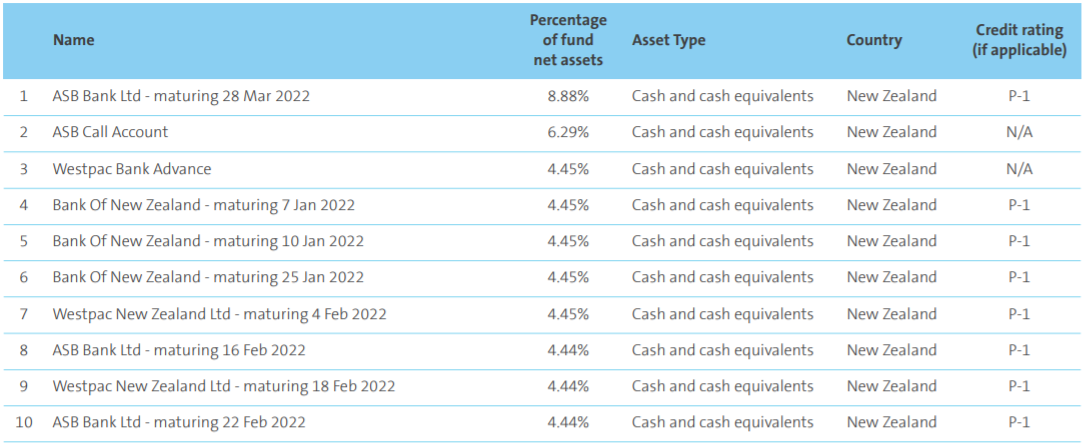

Top ten investments

This table shows AMP' top 10 investments in the Cash KiwiSaver fund, which make up 50.74% of the fund.

AMP KiwiSaver Conservative Fund

The Conservative Fund invests mainly in income assets which includes cash and cash equivalents and fixed interest, with minor exposure to growth assets such as equities, listed property, and listed infrastructure. The Conservative Fund has had a low 3-month return of 0.44% and a 1-year return of 1.91% lower than the since inception return of 4.75%.

*The following is Sourced from AMP Conservative Fund Update

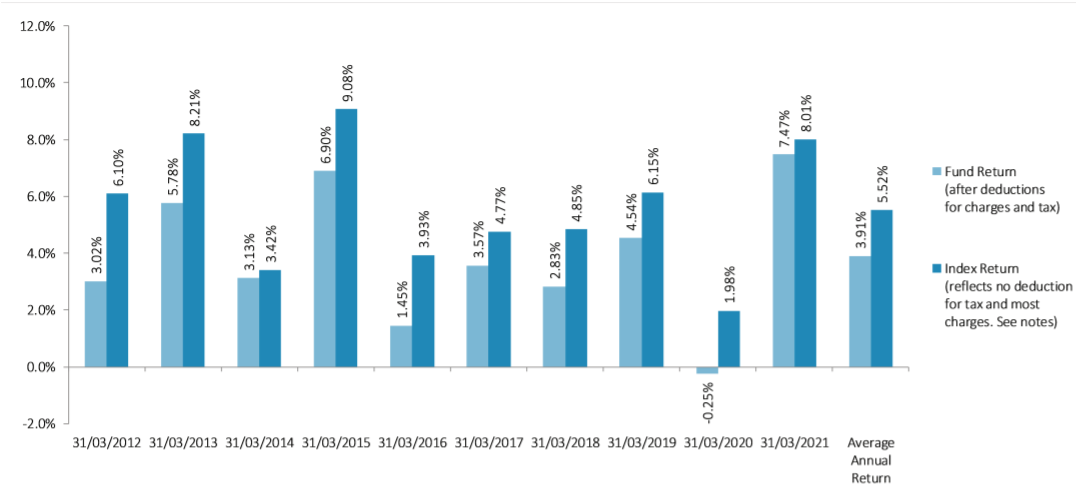

Returns

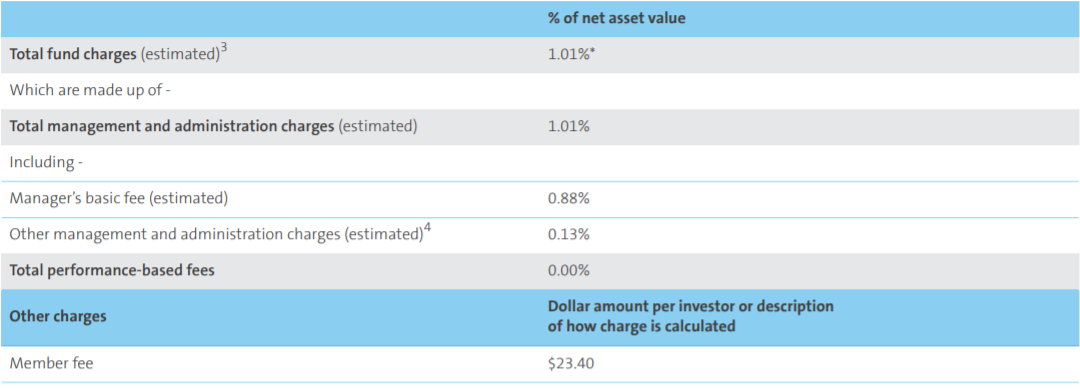

Fees

The annual estimated fee for investors in the Conservative fund is 1.01%.

* Based on a decrease in the Manager's basic fee and Other management and administration charges, the Manager estimates that the total fund charges for

the next scheme year will reduce to 0.84% of the net asset value.

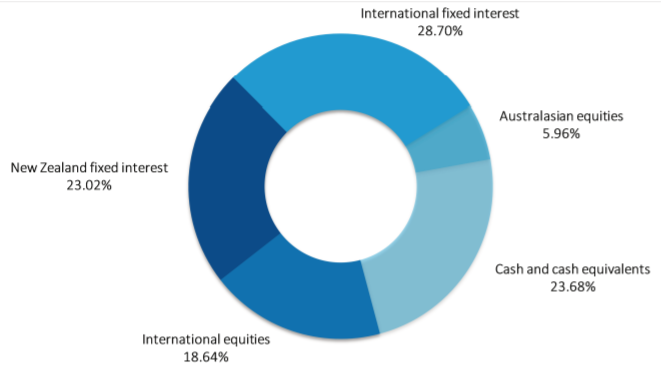

Investment mix

The investment mix shows the type of assets that the fund invests into.

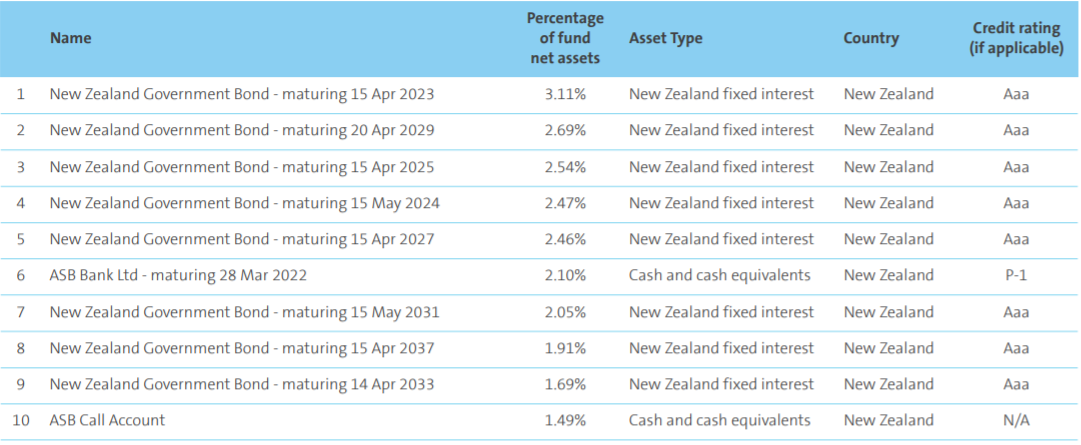

Top ten investments

This table shows AMP's top 10 investments in the Conservative KiwiSaver fund, which make up 22.51% of the fund.

AMP KiwiSaver Moderate Fund

The AMP Moderate Fund aims to generate moderate returns by investing primarily in income assets with a moderate allocation to growth assets. The Moderate Fund saw a 1-month return of 0.97%, and the fund is achieving its yearly goal by having a 1-year return of 4.04% which is close to the 5.90% return since the inception of the fund.

*The following is Sourced from AMP Moderate Fund Update

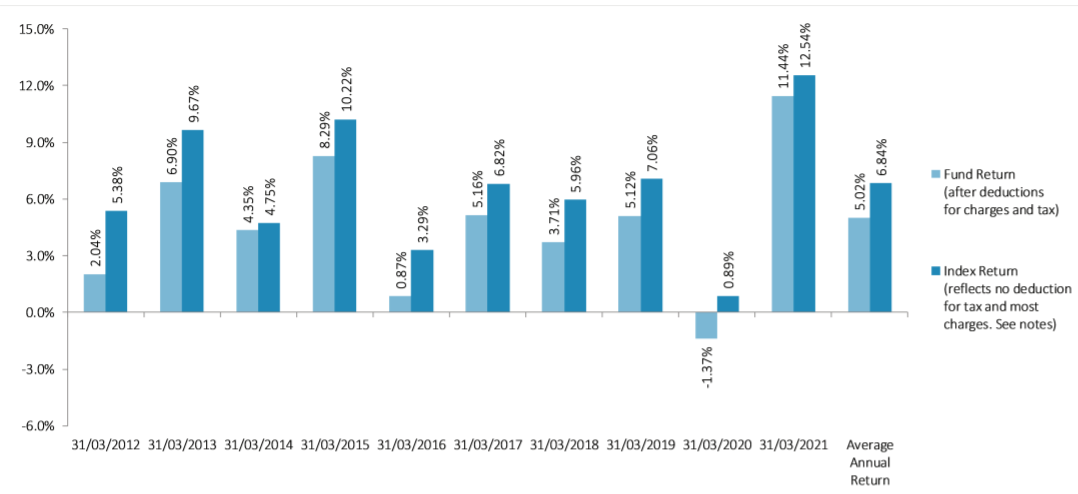

Returns

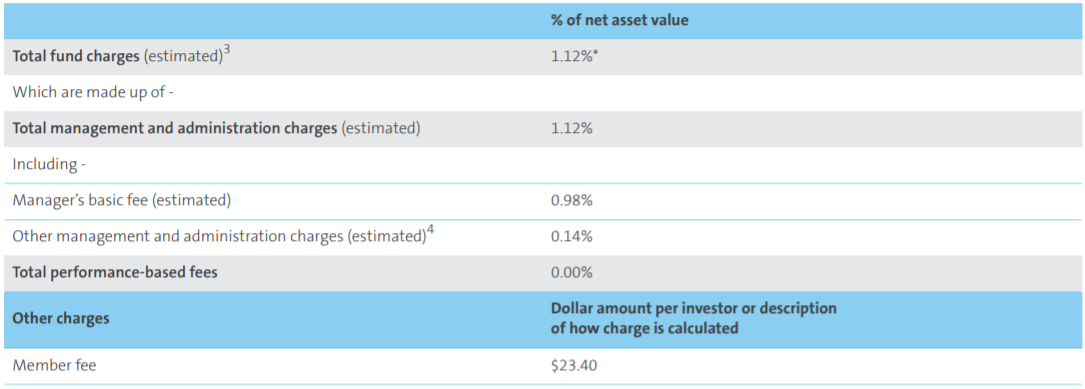

Fees

The total annual fees for investors in the AMP Moderate fund were 1.12% per year.

* Based on a decrease in the Manager's basic fee and Other management and administration charges, the Manager estimates that the total fund charges for the next scheme year will reduce to 0.88% of the net asset value.

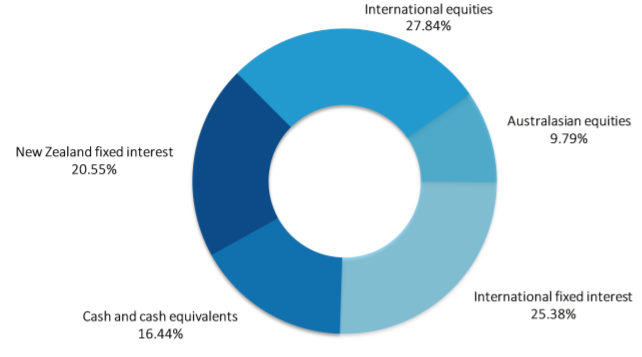

Investment mix

The investment mix shows the type of assets that the fund invests into.

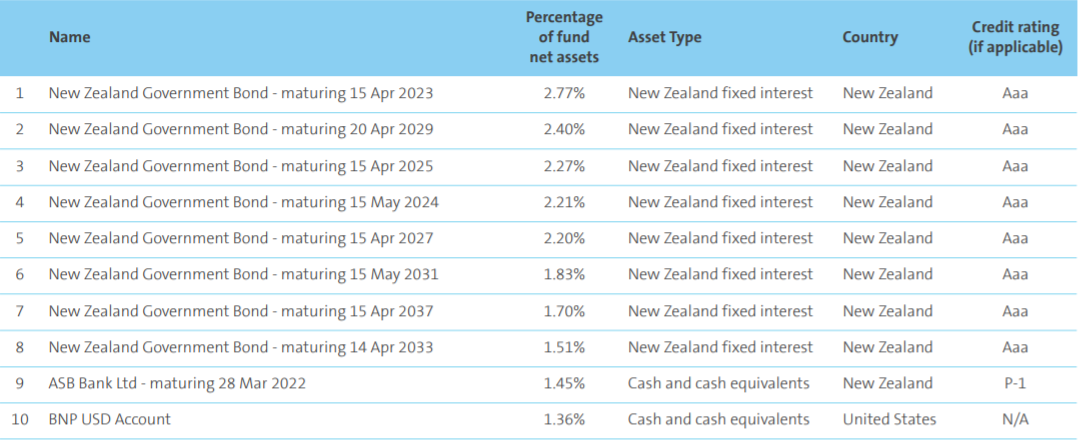

Top ten investments

This shows AMP’s top ten investments in AMP Moderate Fund, which make up 19.70% of the fund.

AMP KiwiSaver Moderate Balanced Fund

The Moderate AMP Balanced Fund has the investments in an allocation to growth assets that broadly equals the allocation to lower-risk income assets.

The fund aims to achieve medium returns, and is aimed at investors with balanced volatility. The Fund has had a 3-month return of 1.78%, and a 1-year return of 6.05% close to its since inception return of 6.90%.

*The following is Sourced from AMP Moderate Balanced Fund Update

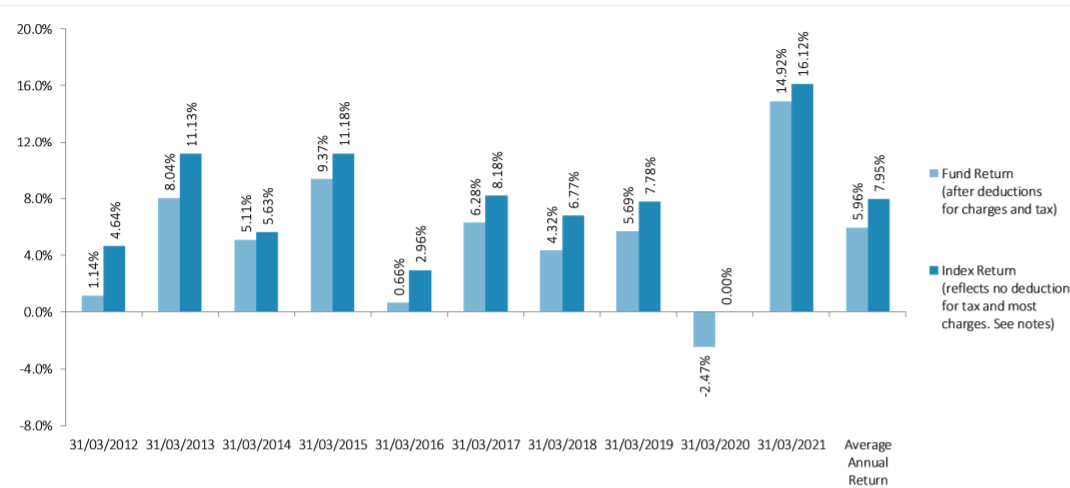

Returns

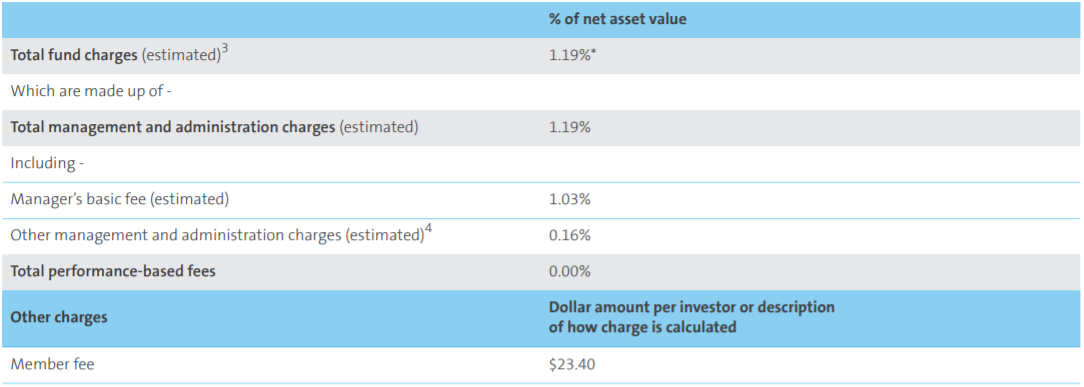

Fees

The total annual fees for investors in the AMP Moderate Balanced fund are 1.19 per year.

* Based on a decrease in the Manager's basic fee and Other management and administration charges, the Manager estimates that the total fund charges for the next scheme year will reduce to 0.89% of the net asset value.

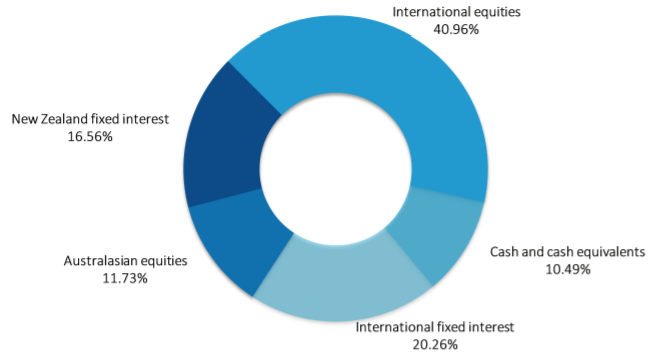

Investment mix

The investment mix shows the type of assets that the fund invests into.

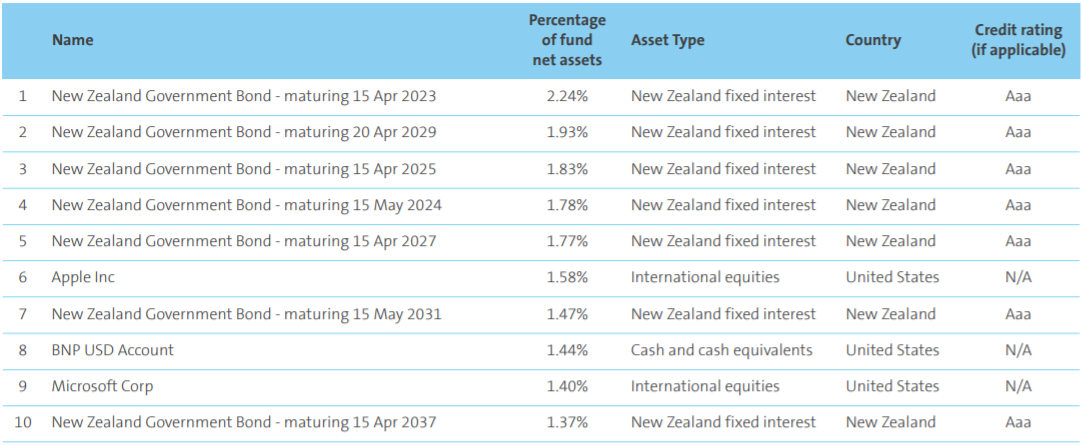

Top ten investments

This table shows AMP’ top 10 investments in the Moderate Balanced KiwiSaver fund, which make up 16.81% of the fund.

AMP KiwiSaver Balanced Fund

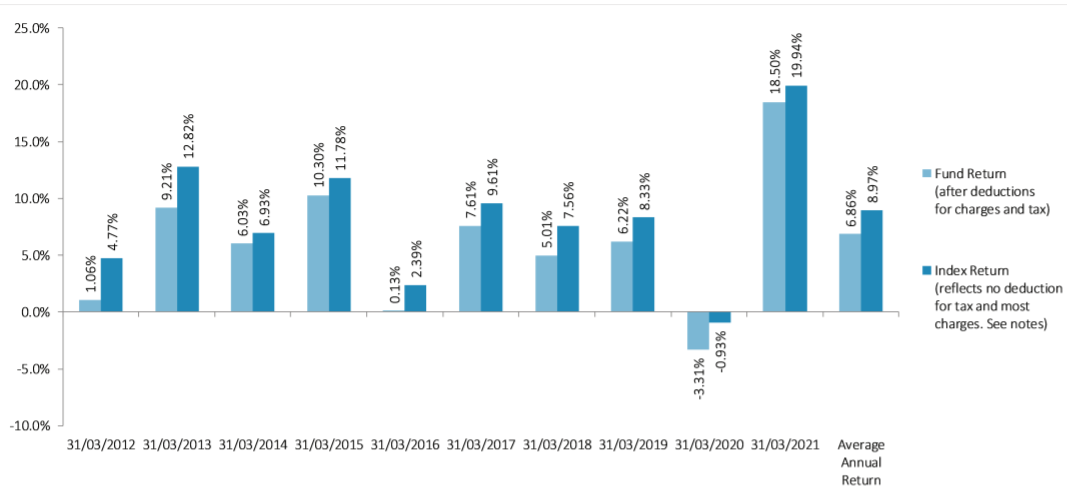

The AMP Balanced Fund is focusing on investing in a balance of income assets and growth assets, and is aimed at investors with balanced volatility. The Fund has had a 3-month return of 2.06%, a 1-year return of 8.03% higher than its since inception return of 7.87%.

*The following is Sourced from AMP Balanced Fund Update

Returns

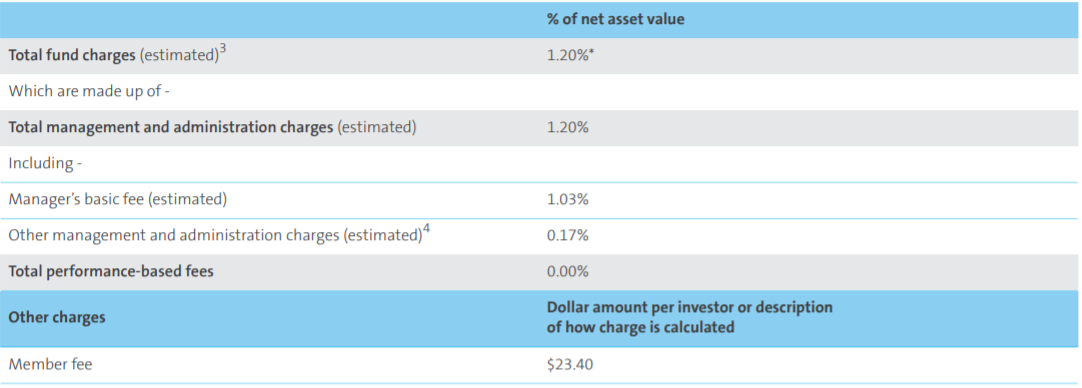

Fees

The total annual fees for investors in the AMP Balanced fund are 1.20% per year.

* Based on a decrease in the Manager's basic fee and Other management and administration charges, the Manager estimates that the total fund charges for the next scheme year will reduce to 0.89% of the net asset value.

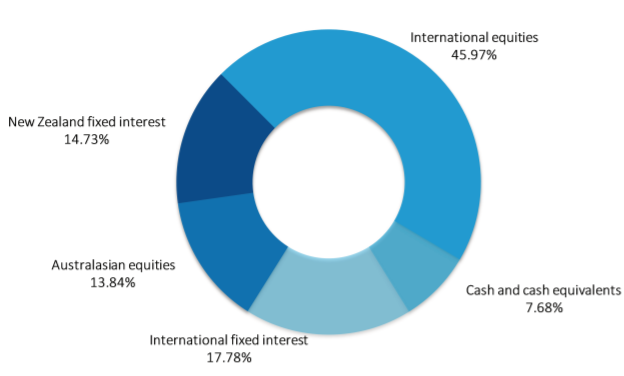

Investment mix

The investment mix shows the type of assets that the fund invests into.

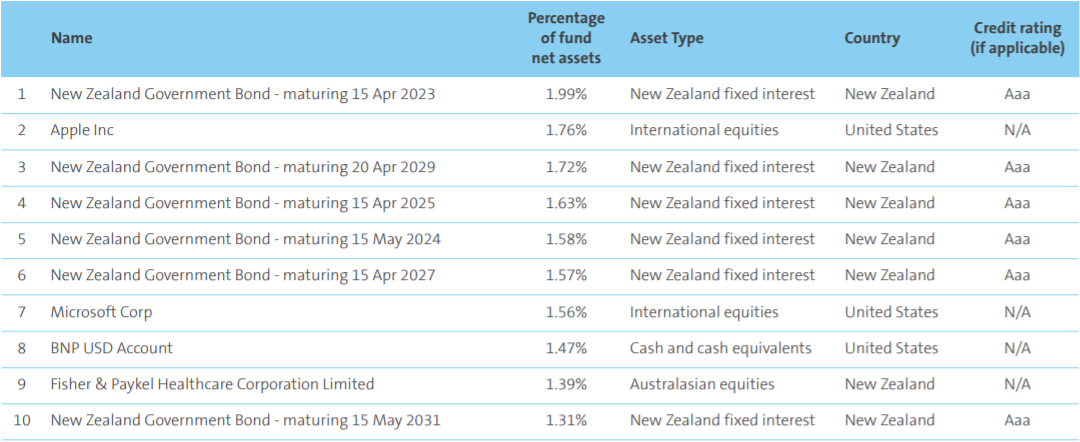

Top ten investments

This table shows AMP’s top 10 investments in the Balanced KiwiSaver fund, which make up 15.98% of the fund.

AMP KiwiSaver Growth Fund

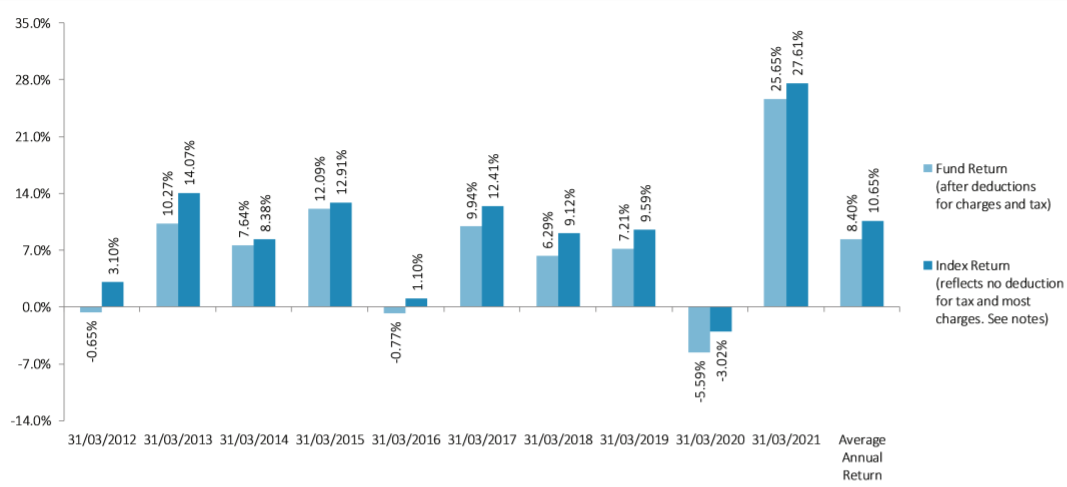

The AMP Growth Fund invests mainly in growth assets with a lower allocation to income assets, and aims to achive a medium to high returns. The Growth Fund has had a 3-month return of 3.02% and a 1-year return of 11.83% exceeding to the since inception return of 9.49%.

*The following is Sourced from AMP Growth Fund Update

Returns

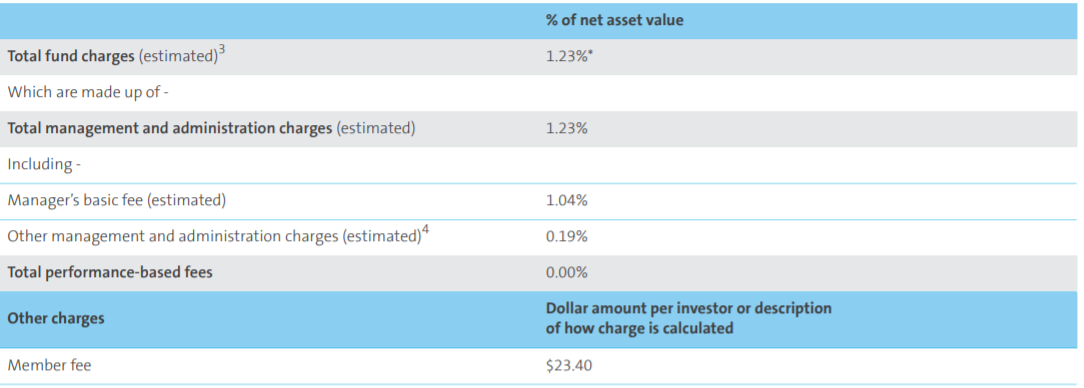

Fees

The total annual fees for investors in the AMP Growth fund are 1.23% per year.

* Based on a decrease in the Manager's basic fee and Other management and administration charges, the Manager

* Based on a decrease in the Manager's basic fee and Other management and administration charges, the Managerestimates that the total fund charges for the next scheme year will reduce to 0.90% of the net asset value.

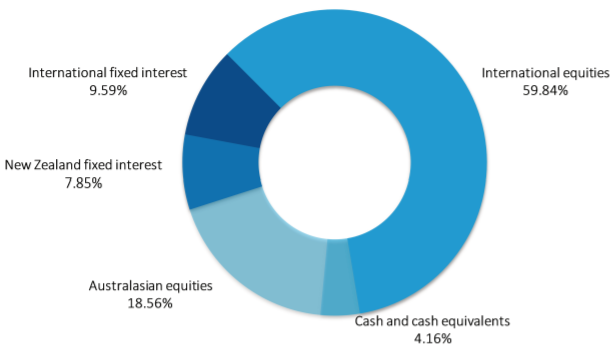

Investment mix

The investment mix shows the type of assets that the fund invests into.

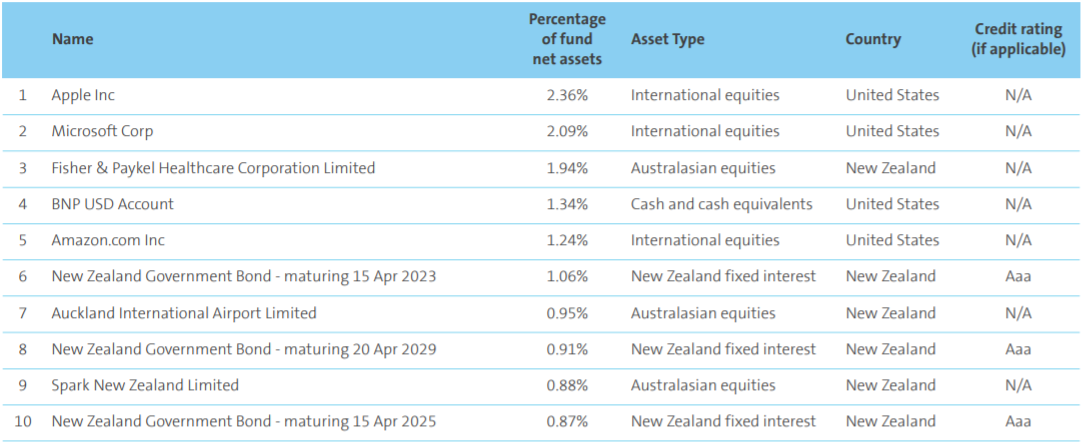

Top ten investments

This table shows AMP's top 10 investments in the Growth KiwiSaver fund, which make up 13.64% of the fund.

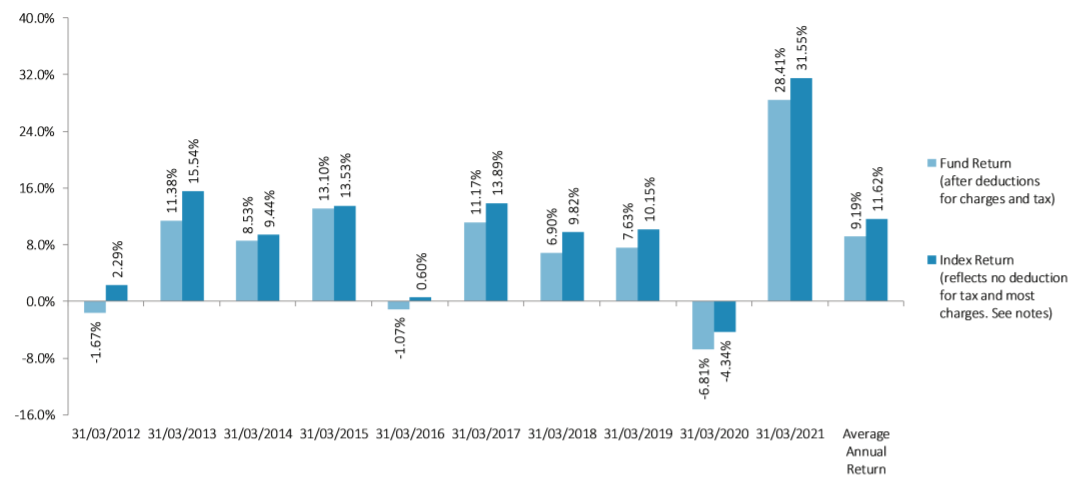

AMP KiwiSaver Aggressive Fund

The AMP Aggressive Fund invests mainly in growth assets with the lowest allocation to income assets, and aims to achive a high returns yet is has the highest volatility. The Aggressive Fund has had a 3-month return of 3.42% and a 1-year return of 13.64% higher than its since inception return of 10.31%.

*The following is Sourced from AMP Growth Fund Update

Returns

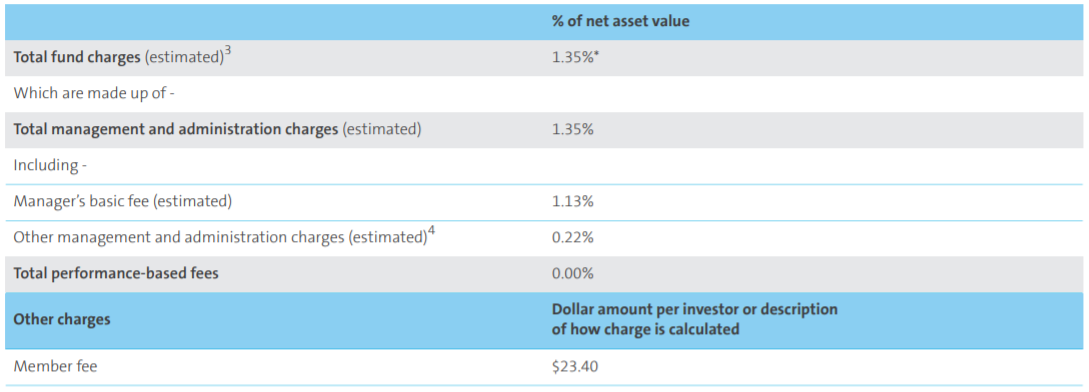

Fees

The total annual fees for investors in the AMP Growth fund are 1.35% per year.

* Based on a decrease in the Manager's basic fee and Other management and administration charges, the Manager

* Based on a decrease in the Manager's basic fee and Other management and administration charges, the Manager

estimates that the total fund charges for the next scheme year will reduce to 0.93% of the net asset value.

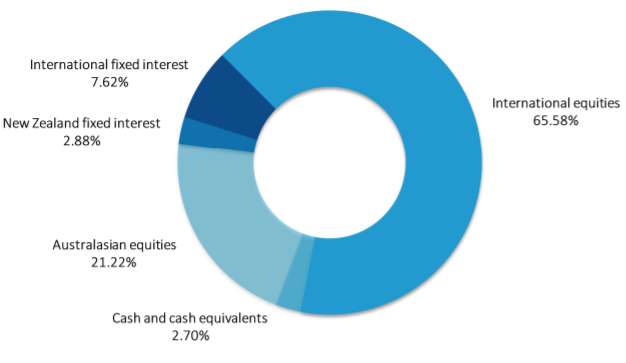

Investment mix

The investment mix shows the type of assets that the fund invests into.

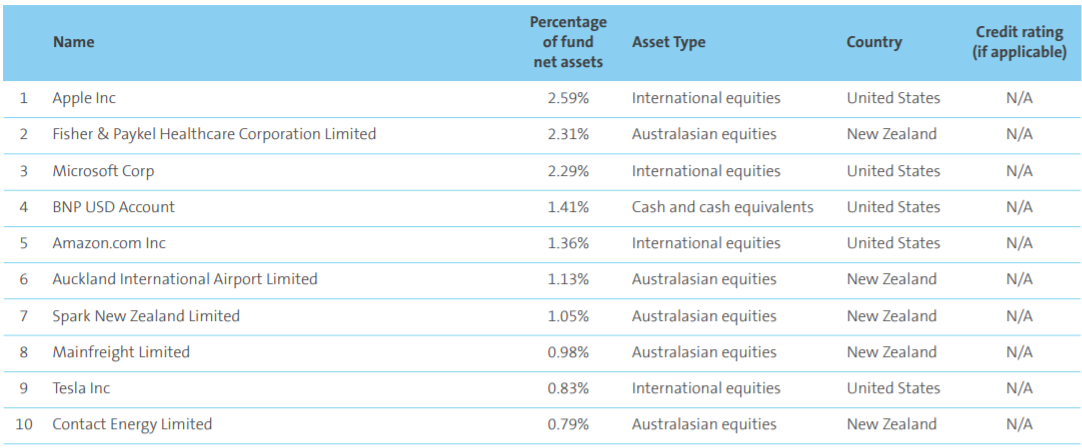

Top ten investments

This table shows AMP's top 10 investments in the Aggressive KiwiSaver fund, which make up 14.74% of the fund.

Data for AMP KiwiSaver funds has been sourced from AMP KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if AMP has the appropriate fund that aligns with your values, retirement goals, and situation, complete National Capital’s KiwiSaver Healthcheck.